London stocks followed the pattern of most markets over the first quarter of 2023: a strong January, drift back in February then alarm in March as the ‘banking crisis’ unfolded.

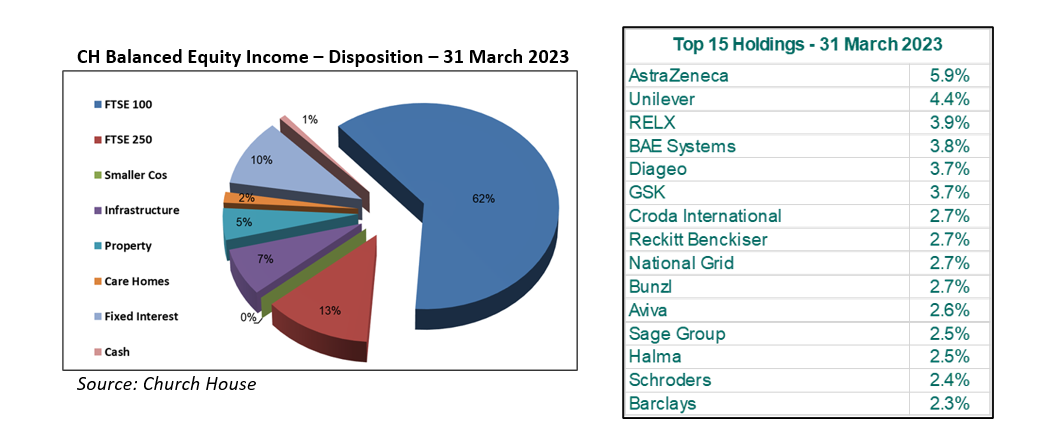

As was the pattern last year, mid-sized and smaller companies under-performed. The disposition of the Balanced Equity Income portfolio is broadly as it was at the end of December, though the infrastructure slice has shrunk after the sale of one small holding and a weak period for the sector (right).

The dividend due at the end of May will be around 30% higher than last May’s payment, reflecting an improvement in dividends from the underlying companies. A modest shuffling in positions of the top holdings (see below) reflects continuing strong performance from BAE Systems and RELX and poor performance from the financials, Aviva and, most notably, Barclays. Other than a modest ‘top slice’ of the biggest holding, AstraZeneca, which had a good run-up in February, we have not made any changes to these holdings. All the companies in the list have increased their dividends over the year (though GSK is not a ‘clean’ comparison having split off Haleon last year, their policy is now for a ‘progressive’ dividend).

The Financial holdings were generally detractors from performance. Close Bros sank after significantly raising provisions on its legal lending business and the insurers Aviva and Phoenix fell back with the dour mood in the banks. Another sector to struggle was Infrastructure where there was pressure on valuations of their (long-term) projects (from last year’s move up in long-term interest rates). We sold the last of our holding in Triple Point Energy Transition, which we felt was unlikely to achieve sufficient scale to achieve its aims.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?