It has been a breathless start to 2026 for investors.

The first few weeks of the year at Church House are generally set aside for annual reporting and offers a timely opportunity for some introspection. No such luck this year, we had barely logged in before US Delta Force had bundled Nicolás Maduro into a helicopter, Jay Powell had become the target of a criminal investigation and Greenland was named target number one.

The good news is that Donald Trump has since moved back onto more market friendly rhetoric, supporting the “TACO” (Trump Always Chickens Out) theory and more general consensus economic view that we started the year with that markets will muddle through in a Goldilocks scenario (not too hot, not too cold). We are more sceptical of this consensus because:

- Pride: attempting to make predictions of how Donald Trump will behave in future is famously difficult. One of the few things that we would be confident predicting is that he will continue to be an extremely proud and reactive man. If the market shouts ‘TACO’ too loudly the President might just decide to prove it wrong.

- Market reaction: at the headline level markets have come through the latest round of macroeconomic noise relatively unscathed but there have been some notable underlying changes that one cannot ignore and that could have detrimental long-term effects.

The first point to make is that the US dollar has had a rotten start to the year and now stands at its lowest level since early 2022. Donald Trump has publicly stated that he supports a weaker dollar as it helps US exporters and during his first premiership the dollar index was down 10% overall. At current levels the dollar derating in Trump’s second presidency is also around 10%, but it is in danger of breaking lower from here. One gets the sense that overseas (non-US) investors, businesses and governments are looking to reduce US (and so dollar) exposure where it is sensible and achievable to do so over the long-term. To pick just one example of this, look at how swiftly Canada has shifted from US to China car imports. The global leaders might have left Davos all smiles, but trust in the US as the bastion of global free market dynamics is at a generational low.

When markets are nervous and political tensions are escalated, what better to focus on than ‘hard’ assets that one can lay their hands on and call their own – hence the extraordinary strength in gold, silver and industrial commodities in recent months. What began as a steady and seemingly understandable upward move in commodity prices, morphed into speculative territory in the final quarter of 2025 as leveraged ‘investors’ and passive funds piled in. Taking the example of copper, the initial inflation in prices was seen when production was hit by mudslides at Grasberg (the second largest copper mine) in September 2025 but since then it has been momentum traders bidding each other up. Over the weekend we hear news that a Chinese metal dealer nicknamed The Hat has fled the country after failing to pay for a shipment of copper, revealing the tip of what looks like a nasty iceberg of dodgy dealing, typical top of market stuff. Let us hope that the knock-on is relatively limited for global investors but the fact remains that the real use of commodity markets is to facilitate trade of commodities between those who have the assets (E.G. miners) to those who need the assets (E.G. a factory). So far US inflation has remained below levels seen during the Biden-years and the effect of tariff wars has not hurt the average US consumer notably, but with copper being such a key component to all electronics, how long does or can this remain the case if its price is 44% higher year-on-year?

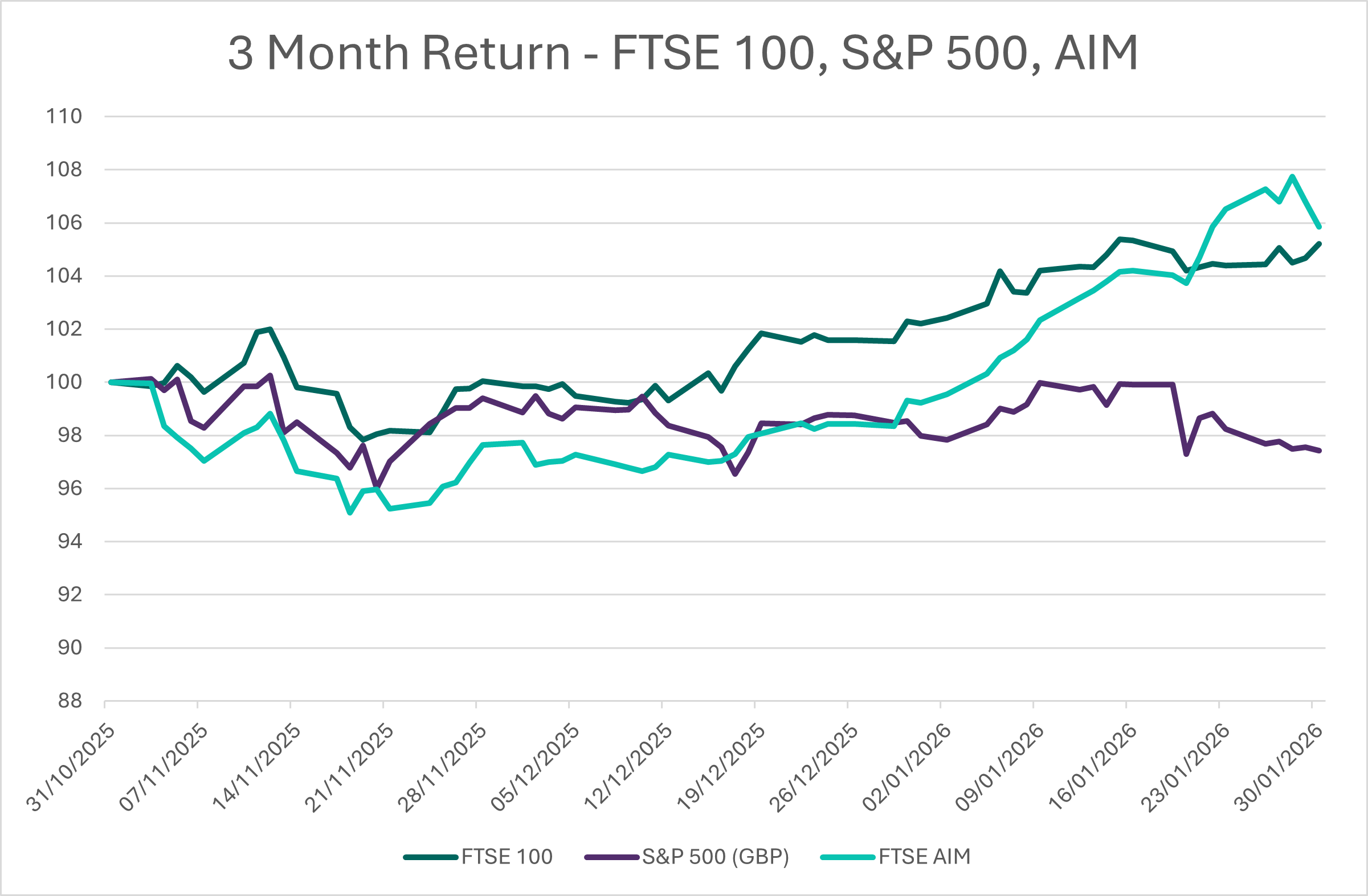

Against this backdrop one equity market that has quietly been making a comeback is the UK. The FTSE 100 rose 2.9% in January and, even more astoundingly, UK smaller companies are doing even better, with the FTSE AIM up 6.7% over the same period. Whisper it quietly, but Gilts have been relatively steady on a global basis (unlike Japanese bonds) and credit spreads remain tight. Could this be the year for investors to stay closer to home (at last)?

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?