Cranley Macfarlane explains why qualitative analysis builds investment conviction beyond the numbers.

As an investment manager I spend a good deal of my day analysing data: a company’s financial results, valuation metrics, historical returns and earnings forecasts. I also build financial models to help calculate my own fair value for a company’s share price.

These tasks involve a relatively rudimentary form of quantitative analysis. There are some investment funds that rely solely on more sophisticated quantitative analysis. Renaissance Technologies, with its chain-smoking founder Jim Simons, is perhaps the most famous. It has delivered outsized returns for years by identifying patterns within the data and, using assumptions such as mean reversion, trading accordingly. In fact, Renaissance has been at the forefront of developing AI and machine learning models for 40 years. Sadly, its flagship fund has been closed to external for 20 of those years.

Yet there is another type of analysis that is crucial to our investment process.

Where quantitative analysis is by its nature backward looking, qualitative analysis considers other factors to try and understand the past and make a judgement on the future.

Take, for example, Rolls Royce. After its share price rose 200% in 2023 and its price-to-earnings multiple had doubled, from a quantitative basis the shares may have seemed expensive. Yet qualitative analysis may have led one to the conclusion that the rally in share price had further to go as the turnaround strategy of the new CEO, Turfan Erginbilgic, took hold. The share price has risen a further 220% since.

The quality of a company’s management, that management’s strategy for the business, the company’s business model, the company’s competition, are all important considerations, as well as wider macroeconomic and geopolitical events. Not all of these can be gleaned from ChatGPT scraping the internet. Rather it is one-to-one meetings, visits to a company’s factory and calls with competitors and customers that help us build our conviction.

My colleague Fred Mahon had a recent example. On a call with the management of a company he was considering investing in for his Human Capital Fund, they told him that “we openly stole most of our business model ideas from Roper Technologies”. Fred knows Roper well. It has grown at a compounded annual rate of 19% since its IPO in 1992, and Fred was delighted to hear that this company’s management are trying to replicate that.

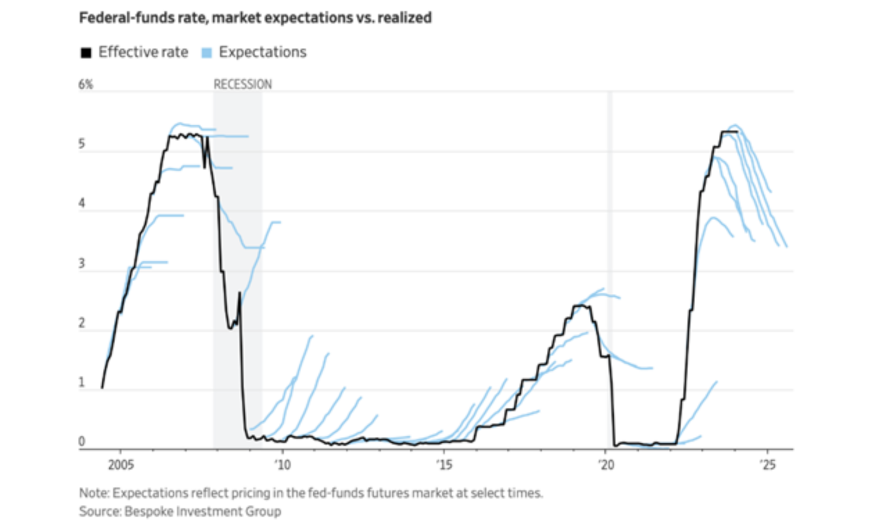

Of course, one does not need to come to one’s own conclusions. One can rely on the wisdom of crowds and use the consensus view of the market as the basis for future expectations. However, as can be seen in the chart (above right) showing the market’s expectation for the direction of interest rates in the US versus their actual path, the market does not always get it right. If this chart is anything to go by, it rarely does.

Differences of opinion are what makes a market. Somebody’s buy order is another person’s sell. Therefore, it is imperative to build one’s conviction when making investment decisions. Quantitative data is part of that, and the market’s expectations also. But so too is an off-the-cuff remark in a meeting with a company’s management team. And it is that qualitative analysis that is the hardest to replicate.

More articles from Cranley.

Important Information

The contents of this article are for information purposes only and do not constitute advice or a personal recommendation. Investors are advised to seek professional advice before entering into any investment arrangements. Please note that we are not tax experts, and you should seek professional advice concerning your personal tax affairs from qualified advisers, such as tax accountants.

Please also note that the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?