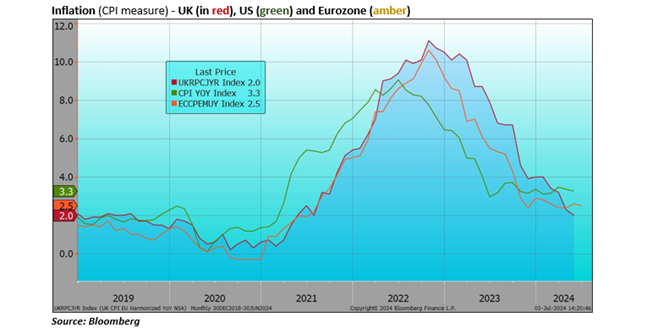

Inflation has continued to ease but elections and their aftermaths are beginning to take over from economics so this is probably the last time that we will be showing this chart for a while.

Our guess would be that we have seen the decline in inflation stats for now and the next step will be harder with ‘sticky’ services inflation in the mix. There have been no further moves from the principal central banks to lower their base rates after the European Central Bank (ECB) move early in June. The Swiss central bank, in a different orbit to the rest of us, has just cut their rate to 1.25% from 1.5%, their peak rate was 1.75% (though they had started from a lower base of minus 0.75%). Post-election economics permitting, we would expect the Bank of England to start to reduce UK rates in August/September. In America, expectations for a cut have moved out to November time. But, of course, that would run into the Presidential Election so could present a problem.

UK ten-year Gilt yields have continued to range trade between 4.1% and 4.4% while thirty-year yields have been trading between 4.5% and 4.8%. Over the first half, the ten-year Gilt is down around 5% in capital terms and closer to 10% at the long end. The higher yields available at the short end of the market still look the most attractive to us. The pattern in America is similar with yields up over the first half awaiting/hoping for some gratification from Jerome Powell.

European bond markets have been turned a shade upside down by France’s election problems (though a hung parliament seems to be the most likely outcome at present). The French ten-year yield hit 3.3% at the end of the month and has seen a steady widening of the spread to German bonds.

Equity markets ended the half year on a positive note, world indices being up around 3% over June, but it hasn’t really felt that good. Out of a list of 120 international leaders that I am looking at there are more down than up over the month… Once again the market has been led by a small number of the big US technology names. Apple has been the big contributor in June as the unveiling of their AI strategy really caught the market short and led to a 10% gain, Amazon also gained 10%, Meta 8% and Nvidia a shade more. The move also rattled around some of the other tech names: Adobe rose 25%, Salesforce by 10% and SAP by 14%. The only non-technology name among the major companies to put in a good showing was the Swiss pharma, Roche Holding.

Negative contributions to the equity markets are easier to find. The French market was 9% off from the May peak by the end of June with Société Générale down by 20% and BNP Paribas not far behind, TotalEnergies fell around 7%. L’Oréal was down by 9% but this was more to do with their reporting of slower growth than French politics. The car makers featured a weak performance from Volkswagen but in the consumer discretionary names generally it was Nike that produced the real surprise with a 20% fall at the end of the period following a dismal outlook forecast.

And so back to elections, ours tomorrow and round two for France on Sunday. At least it would appear that ours will produce a clear outcome and a centre left administration, just possibly, maybe, that could herald a period of some stability… I liked the observation from The Economist that the Conservatives need a long lie-down. Meanwhile, in America, we had a dreadful performance from incumbent President Biden (could he do the decent/sensible thing?) and the Supreme Court appeared to give former President Trump (and other Presidents) immunity from prosecution…

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?