The Bank of England surprised markets with a ‘hawkish hold’ of the Base Rate at 5.25% in a 5/4 split decision decided by the Governor’s vote.

The Bank of England surprised markets with a ‘hawkish hold’ of the Base Rate at 5.25% in a 5/4 split decision decided by the Governor’s vote.

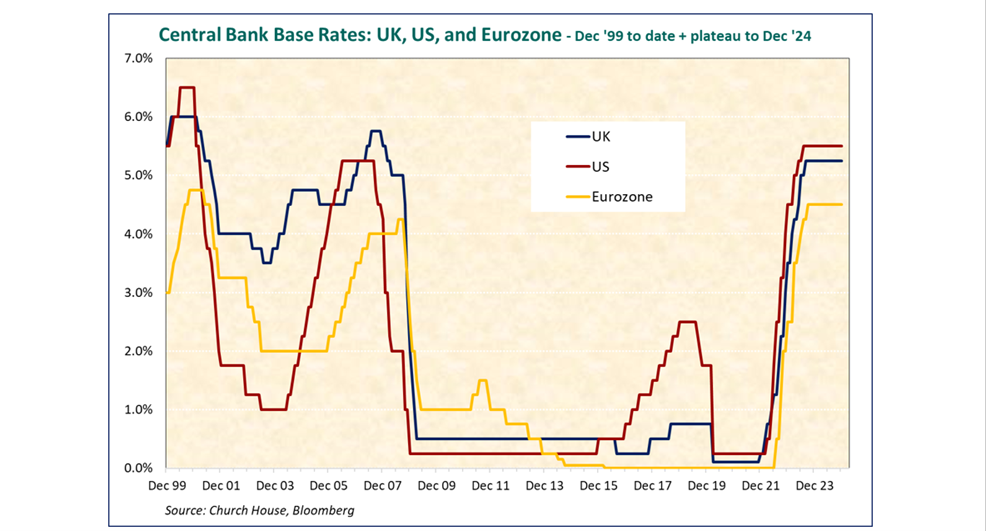

The US Federal Reserve held at 5.5%, but warned that they could go higher, while the European Central Bank (ECB) increased by ¼% (a ‘dovish raise’...) but indicated that that would be that for now. The mood music from central bankers is that we should be expecting a ‘Tabletop’ plateauing of rates and not the cuts that many were expecting next year.

So, we have extended our chart of Base interest rates from December 1999 to reflect this purported tabletop pattern, right.

We have sympathy for the central banks in that the weapons at their disposal are, essentially, limited to interest rates and quantitative tightening (/easing). In the wake of the massive fiscal stimulus (government spending), notably in America, supply chain disruption and Russian impact on energy prices this has clearly been difficult. But, as we have said many times, they were too slow to react and now that fiscal stimulus is largely spent, and supply chains are working.

The effects of the rate increases of the past year are being felt more widely and economies are slowing, so it is correct for central banks to pause their rate increases now (“higher for longer” is the mantra), whether that plateau pattern for rates, as suggested on the chart above, holds is a moot point.

Meanwhile, as my colleague Jerry Wharton puts it, rather pithily: “better higher-for-longer than higher-and-higher…”

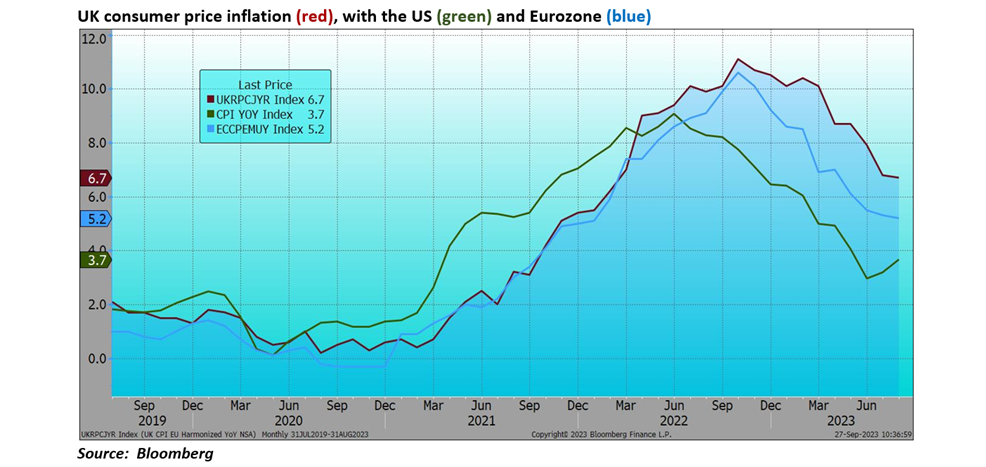

Of course, it is still all about inflation, and it was good to see the UK coming back into line rather more than it was, notably in the ‘core’ rate, which undershot quite markedly. Below is the unfolding picture for the CPI, noting that markets are nervously watching the oil price, which has moved up from around $75 in May/June to $95 today, squeezed higher by supply reductions from Saudi Arabia and Russia.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?