As the third quarter draws to a close, international equity indices are hitting new highs despite a serious escalation of the conflict in the Middle East and an imminent US Presidential Election, which appears to hang in the balance.

On the more positive side, the US Federal Reserve (the Fed) began to cut rates with a surprise half per cent move and the Chinese authorities appear to have recognised the difficulties for their domestic economy and have introduced a massive stimulus package.

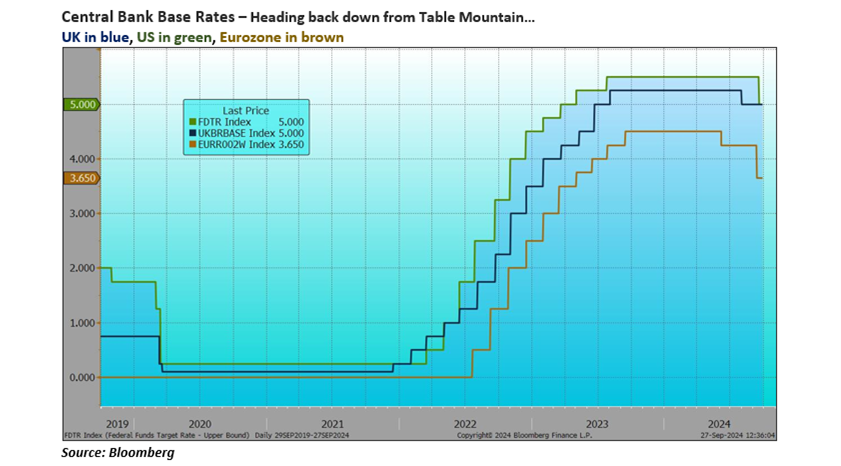

As central bank base rates finally come down from the plateau, the question becomes, how far will they go and, did they wait too long? The Fed is hinting at a ‘terminal rate’ around 3% and it does appear likely that they will continue to cut rates after the Election. US employment is weakening but looks likely to remain sufficiently robust for Jerome Powell to achieve the fabled ‘soft landing’ for the American economy (and inflation indicators are remaining benign). Caveat a difficult outcome for the Presidential Election, of course.

The European Central Bank has cut rates again and this looks correct as the eurozone appears to be stagnating with consumers and business in downbeat mood, notably in Germany and France. Further falls in rates appear likely over the rest of the year. Here too inflation does not appear to be a problem with France and Spain having just reported CPI below 2%.

The Bank of England held rates steady this month but will probably resume cuts later in the year as the economy takes a pause (why on earth have the new Prime Minister and Chancellor been going out of their way to depress confidence – that is hardly a ‘platform for growth’). But the UK does appear to be the odd man out as far as inflation is concerned, it persists in feeling rather more sticky in this country. Possibly this will prove to be too pessimistic (look at the strength of the pound sterling), but for now it is hard to see Base Rates much below 4% in the near term.

The Fed’s half point move in rates could be construed as more political than they like to be in front of an election. For their sake, let’s hope that Kamala Harris wins in November, Donald Trump is not a fan and, as somebody who considers himself to be uncommonly good at predicting interest rates, is likely to want to interfere in the Fed’s decision making (and independence).

The Chinese economy has been struggling and appeared to be spiralling into a depression. Cue a concerted rescue package, starting with rate cuts from the People’s Bank of China (PBoC) but appearing likely to include fiscal measures and possibly even support for their ailing banks. As TS Lombard puts it: “It certainly seems as though Beijing has finally met its pain threshold”. The Chinese stock market saw the mounting problems and fell 15% from May until the PBoC’s started its recent move, since when it has recovered most of the lost ground (though it is still a way off the early 2021 peaks).

Longer-term yields in the bond markets fell back with lower bank rates and slowing economies. The US ten-year yield is back at 3.8%, a steep fall from levels around 4.7% in April, while the German equivalent is now down to 2.1%. The UK ten-year Gilt yield is a shade below 4%, not quite such a dramatic move as markets fret over how much the new Labour administration might have to borrow.

Equity markets in general are at or close to all-time highs, though the leadership has changed. All the markets convulsed in the early days of August following weaker than expected US employment figures and volatility has remained elevated since. Japan saw the most violent swing with a 20% fall over just a few days as the Bank of Japan also raised its base rate to 0.25%(!) but practically all the ground has been recovered since.

The S&P 500 has gained around 5% over the quarter while the NASDAQ, previously dominant, has gained around 2.5%. The move has shifted away from the mega-cap stocks, the Russell 2000 Index of smaller US companies is up around 8%. London has only gained around 2% but this is thanks to a poor performance from the heavily weighted oil majors, Shell is off around 14% and BP even more (the price of oil has fallen around 17% over the quarter), along with some (rare) weakness in AstraZeneca. Sterling has continued to gain, it is up around 6% v. the US dollar since the end of June, and this is reflected in the world equity indices being flat in sterling terms.

It is hard to know what best to say about the situation in the Middle East, which appears to be escalating yet again. Beside the dreadful situation that so many civilians appear to find themselves in, this still feels like a serious risk to wider stability. Combined with the forthcoming knife-edge Presidential Election, the final quarter appears likely to be volatile again.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?