After the excitement of December, bond markets have seen a distinct change of heart into the New Year.

The US ten-year yield, which had hit lows around 3.9% at the end of December has backed up to 4.3% and the UK ten-year Gilt yield, which hit lows around 3.5% at the end of the year is now back to 4.1%. Of course, this translates to falls in capital value for the UK ten-year Gilt of around 4.5% and around 8% for longer dates. While central banks continue to hold their rates for the moment, forecasts for the first to reduce have been edging out in the wake of resilient US inflation and continued strength in their economy.

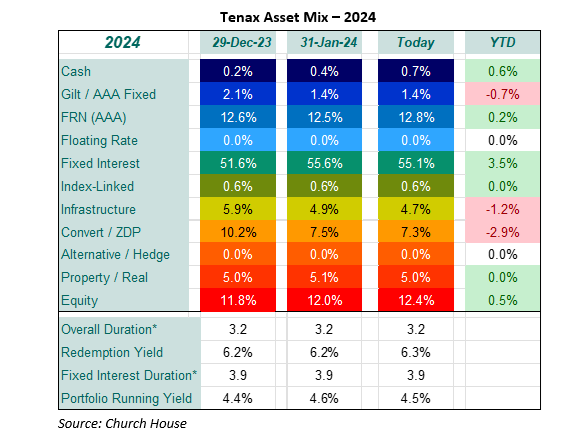

We remain invested at the short-dated end of the bond markets (right, current overall duration* is 3.2), where we can see attractive returns/opportunities. We still do not like longer-dated issues, where the returns do not compensate for the likely risk. Here is the change in the Fund’s asset mix over the year to date, right:

The Fixed Interest (credit/corporate fixed interest) section remains the largest portion of the Fund’s portfolio though this is concentrated at the short-dated end. The increase in weight does also reflect the reduction in Convertible exposure (right). We have seen some opportunities to add in Fixed, we took two new issues, one from Credit Agricole of 5.375% stock due in January 2029 and one from Traton Finance (Volkswagen) of 5.625% stock also due in January 2029.

The Convertibles exposure is around 3% lower, we sold one of the largest positions here, a convertible from Primary Health Properties due in July 2025. We still have high regard for PHP but were able to sell the bond on a yield basis around 1% lower than we could achieve in conventional short-dated bonds. With the reduction in PHP exposure from this sale we have added modestly to the holding we have in their equity. We expect PHP to come back to the market over the next year with a new convertible issue to refinance the soon-to-expire issue.

Equity markets overall have carried on regardless of the change of mood in the fixed interest markets. As before though, this has a narrow focus on US technology (Nvidia!), the UK market has not made any progress over the year to date. One has to wonder whether this isn’t beginning to look a shade overdone. Unfortunately, there is a lot of scope for unpleasant surprises (possibly even unpleasant inflation surprises) from this year’s roster of geo-politics and elections. While we do expect the central banks to start to reduce their rates over the course of the year, we do not expect them to head all the way back down again. The ‘steady state’ (whatever that is now) or terminal rate definitely looks to be higher now.

*Duration represents the number of ‘periods’ that it will take to repay an initial investment in a fixed interest security. It is not the same as the life of the bond or time to maturity, which will be longer. It can also be viewed as a measure of the sensitivity of the price of a bond to a change in interest rates.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?