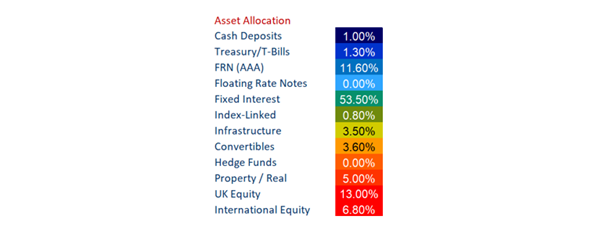

Tenax continued its good performance year to date, demonstrating its resilience even as market uncertainty increases. The asset allocation of the fund remained fairly steady over the quarter as equity markets continued to climb ‘the wall of worry’ that fixed interest markets are warning of.

The equity portion of the fund increased slightly, despite not being exposed to the higher volatility of the AI trade. This was partly due to the strong underlying performance of the fund’s equity positions. The financial stocks in particular, Barclays, Standard Chartered and Aviva continued to do well. Despite their strong performance this year, the shares still remain reasonably valued, which should continue to support the share prices even when rates fall.

A new holding of BAE Systems was added during the period. Along with other European defence stocks, BAE’s share price has benefited hugely from the commitments to increase defence spending by the European members of NATO. Even if governments fail to meet their current targets, the shift in spend will still be significant, the impact of which will last for a number of years. We took advantage of a slight pullback in the share price to initiate a position, and pleasingly the shares swiftly recovered and are already 14% higher than their purchase price.

In fixed interest, credit spreads have narrowed considerably over the quarter as gilt yields moved higher. This was despite the Bank of England cutting the base rate to 4% on 7th August. Much of the action has been at the long-end with 30-year yields reaching a 27-year high in August as the market displayed its concern over the long-term funding of the government’s spending plans.

The fall in the long-end of the market was reflected by a poor quarter for other interest rate-sensitive assets in the portfolio, namely property and infrastructure. These continue to trade at significant discounts to their NAV. While we are mindful of the accuracy of these NAVs, we remain

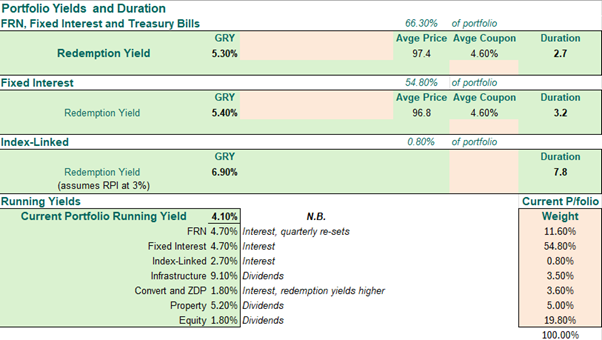

We continue to see no benefit in pushing out the maturity of the bonds that we own, preferring to keep duration short and volatility low. As you can see in the table above, duration has remained steady at 2.7 years, while the overall redemption yield moved slightly lower to 5.3%.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?