As markets ended the year on a positive note it was pleasing to see Tenax rounding off a strong year with a good final quarter.

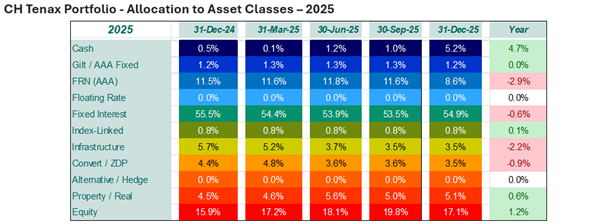

The asset allocation shifted slightly in the final quarter as we took advantage of positive equity markets and a further rate cut by the Bank of England in December.

We took some profits in our financial holdings late in December. Barclays, Standard Chartered and Aviva have done well over the course of the year and we have trimmed these holdings on a couple of occasions. While we remain positive on the outlook for all three, we always keep an eye on the volatility of the fund and do not want to get too over-exposed to a particular sector.

The property holdings of Land Securities and Primary Health Properties had a good final quarter also. The reduction in interest rates will have helped, so too the relief that on the surface the Budget was not as bad as the Government had led us to believe it would be.

In renewable infrastructure, Gresham House Energy Storage continues to recover and has resumed paying a dividend. While a dividend cut is never welcome, we feel that management’s strategy to invest in capacity has proven to be the right one, but we will keep a watchful eye on execution. Unfortunately, SDCL Energy Efficiency Income Trust disappointed the market with a lack of progress on their attempts to sell assets, though they are in negotiations over a ‘significant disposal’ that will go some way to allay the market’s concerns.

In fixed interest, credit spreads rallied thanks to the December cut by the Bank, as well as the relief over the Budget. Inflation also eased from its summer highs of 3.8% and credit spreads are now at their tightest level since the onset of the Global Financial Crisis. While gilt yields at the short-end dropped a little, they remain fairly anchored at the long-end. We have reduced our Floating Rate Note exposure a little, thus increasing duration without having to invest further along the curve.

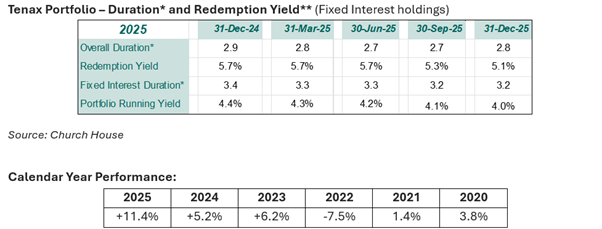

This reflects our focus on maximising returns while keeping volatility low. As you can see in the table, right, duration has moved out marginally to 2.8 years, while the overall redemption yield moved slightly lower to 5.1%.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?