James Johnsen explains why time in the market is more important than timing the market

New clients – or existing clients with new cash to invest – often ask whether it might be better to hold off investing amid such uncertainty about the direction of markets.

2018 was not a good year for global markets as many investors are well aware and it won’t be surprising that many of our clients are worrying about 2019, particularly with the outcome of the Brexit circus and the impact on markets of a ‘no-deal’. My answer to these concerns is the same as with all those others before them – from the Asian debt crisis of 1998 through the Dot-Com bust of 2000 to the Credit Crunch of 2007-09; through all the Eurozone crises and up to ‘Red’ October of 2018. It goes roughly as follows:

- The successful investor is the one who focuses on long-term investment objectives and sticks relentlessly to risk management disciplines to guide his decision. This is in contrast to the retail investor who obsesses about short-term movements and extraneous market ‘noise’

- In the long run – five years or more – history shows that it is not so much about market timing as ‘time in market’. In other words, the sooner you build that fundamental investment traction – a large part of which is all about harvesting income yields – the better

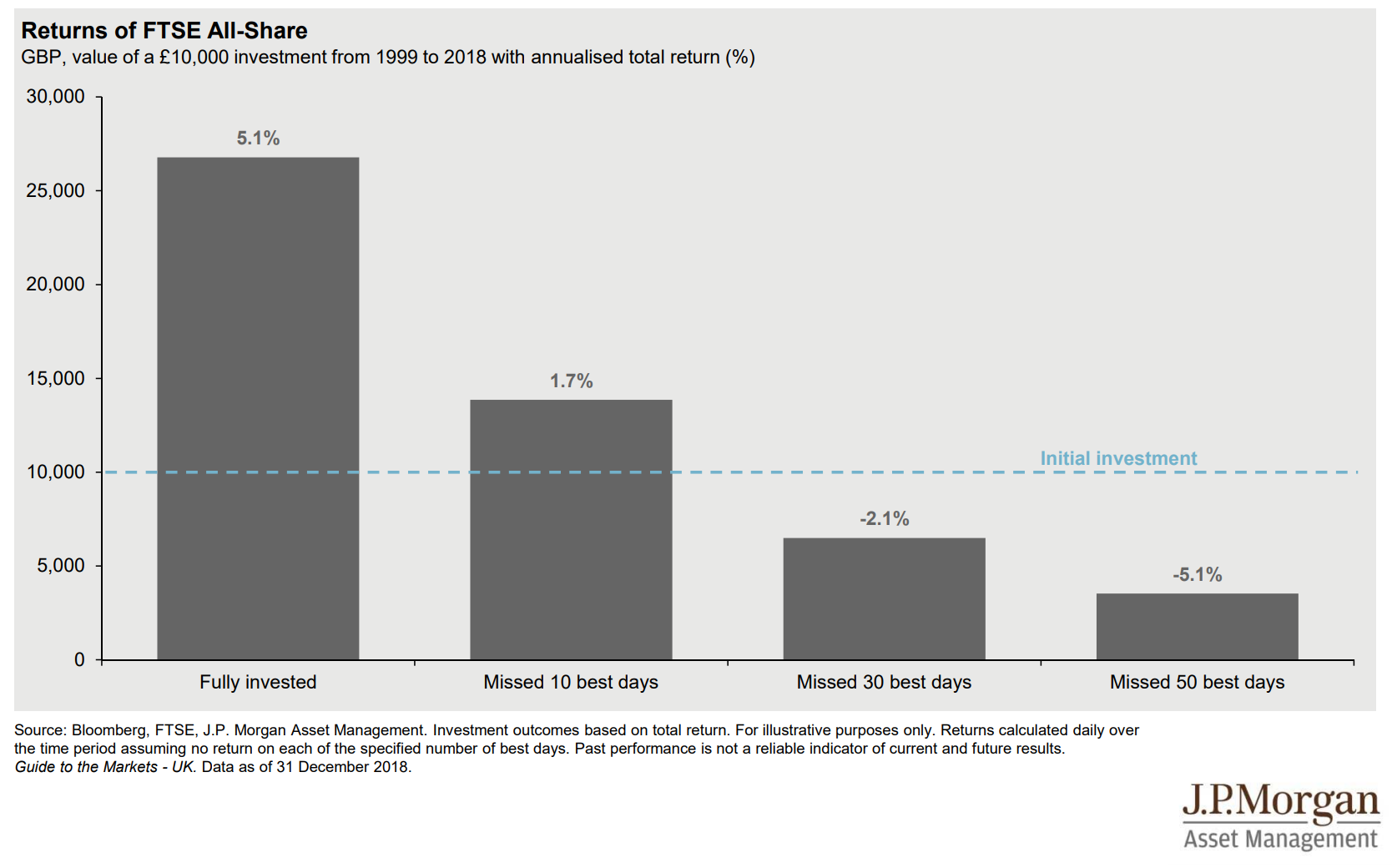

The graph below from JP Morgan Asset Management shows the effect on overall returns when investors miss the best performing days in the market, usually after a period of heightened volatility or perceived crisis. It is one instance where ‘FOMO’ (fear of missing out) should prevail over ‘FOBO’ (fear of better options).

At the moment, clients are inevitably focused on Brexit fears and voice their intuition to leave investment decisions until after March 29th – or when the future may seem clearer. This is understandable but not rational; it is just another manifestation of all of our fears of the unknown and should be recognised and dealt with as such.

There are four practical reasons why investors should not put off making a start investing a new portfolio:

- Typically, at times such as these, we would first of all build out many of the defensive allocations in cash, bonds, infrastructure and other low-risk assets. In the event of a bad Brexit outcome or other bad news, then these allocations act as a vital storm-anchor and some of the assets mentioned will tend to go up (modestly) in value as investors flee to these safe havens.

- Secondly, we have long since assessed the risks to the downside and moved accordingly by increasing allocations to cash, near-cash and safe haven assets months ago .Only now are we looking to expand into risk assets (typically, equities) which have over-reacted during recent volatility and where there are pockets of value beginning to appear. They are looking 9-12 months ahead.

- Thirdly, it always takes time and discipline to invest a new portfolio. Typically, we average in new money across a wide range of assets over a period of months. It is the well-proved discipline of ‘pound-cost averaging’ that means market highs and lows are smoothed and the timing decision is never the crucial one.

- Fourthly, without getting too deeply metaphysical, it must be recognised that waiting is not a proxy for making the decision, it is merely fudging it. The simple truth is that issues – or perceived obstacles to decision-taking – are never removed. There is always uncertainty.

While we will of course try to take advantage of short-term market-moves and exploit tactical opportunities - such as for example, a sudden discount-widening in a favoured investment trust - in the end it is our overall aim to get the correct balance between all the main asset allocations established i.e. to get the ‘risk framework’ in position. This is far more important than short-term market timing concerns. Looking back over all the crises of the nineties, noughties and now the teens, the focus on risk rather than timing has always held good.

Ultimately, it must be the client’s decision to press the button and that he or she is comfortable about handing over control to a discretionary portfolio manager. Having wrong-footed so many other market participants in 1815, Nathaniel Rothschild could afford to be smug when he opined: “Invest at the sound of cannons, sell on the sound of trumpets”. When it is your sacred nest-egg or a sum that you cannot afford to lose, then it is much harder to force yourself to stick to the rules.

Very few are successful at timing the market successfully. The old adage that the market can remain ‘wrong’ longer than you can remain solvent is proved true with almost monotonous regularity. Understanding that there are very few – if any – short cuts to sustainable capital growth in the ordinary investment world is the most important first acknowledgement.

Which leads on the inevitable conclusion that the best investors are the patient ones, who ignore the obsession with ‘market timing’ or worse, the folly of chasing markets up and down and who stick to their long-term objectives and risk disciplines.

At the end of the day, it doesn’t actually matter when you start as long as you make the decision to start. As the old proverb goes, the best time to plant a tree is yesterday.

The next best time is today.

How would you like to share this?