London stocks were up modestly over the third quarter, mainly thanks to the big oil companies following the oil price higher but, of the leaders, GSK and HSBC also gained along with Glencore and RELX.

Further down the scale it remained dull and smaller companies are still completely out of favour. Fixed interest markets saw further falls at the long end but, as the yield curve flattened, small gains at the short end.

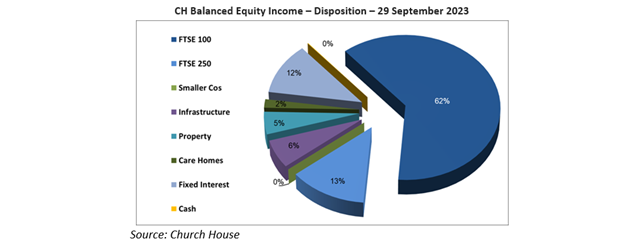

Balanced Equity Income made modest gains over the period, including gains for the fixed interest and some of the property holdings (a pleasant change), but the infrastructure holdings continue to struggle. The Fund went ex-dividend on 1st October, the payment will be around 10% higher than the equivalent period last year, putting the ‘B’ income units on a historic yield of 3.9%. This was the disposition at the end of the period, right.

Among the equity holdings, detractors from performance included Halma, which fell around 15%, no one issue to point to but they have reported ‘de-stocking’ from manufacturers and in healthcare, and Diageo, down around 10%, where it appears that the all-important US spirits markets has gone off the boil for them. More positively, there were good gains for Howden Joinery and BAE Systems along with the housebuilders, Bellway and Berkeley Group, which might come as a surprise. Greggs were down around 4%, unfairly in our view, their growth continues unabated, a similar fall for Kingfisher (B&Q et al) was more justifiable after reporting dull figures.

The top holdings are very little changed. GSK had a much better quarter with some encouraging new drug approvals coming through. Sage Group had another good quarter, and RELX have been a stand-out performer all year. The infrastructure companies remain under a cloud with higher long-term interest rates only adding to the pressure. Target Healthcare appears to have ‘found a level’ and has gained modestly this quarter. All of the conventional fixed interest holdings gained a few percentage points, the Barclays 3.75% issue has crept into the list of top holdings. The index-linked issues were marginally lower overall, notably the longest-dated holding, the Heathrow Funding 3.334% 2039.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?