In a reversal of recent trends, UK small and mid-capitalisation companies outperformed the FTSE 100 Index over the period.

Stock specific reasons aside, strong sterling affecting the short-term earnings of large UK companies (large portion of revenues generated internationally) and a narrowing of the wide valuation disparity between large and small capitalisation companies, are perhaps the drivers.

Given an alarming number of geopolitical concerns, not least, the upcoming US presidential election, is it perhaps time to think of the UK as the proverbial ‘port in the storm’. A stable political environment (despite Labour PR disasters), a ‘cheap’ stock market vs international peers (just look at the number of bids for UK companies) and an improving macroeconomic backdrop would support this view. Now, just don’t do anything silly in the upcoming budget, Chancellor…

Having started the period with a sizeable cash balance, we added to positions in Schroders and Croda on the back of weak figures. Both businesses are going through a period of restructuring/market repositioning and are ‘cheap’ on a valuation basis, with reasons to be positive moving forward. More cash came from our sale of the long-standing holding in Britvic following the takeover proposal from Carlsberg. The transaction is under investigation by the Competition & Markets Authority and we opted to take the prudent approach, selling our holding at a modest discount to the bid price.

A new holding in the portfolio is BT Group (we have held them before), a widely recognised name who, under new leadership, seem to be running a much leaner operation. The shares trade on a depressed valuation and offer a good dividend yield, with the prospect of significantly increased cash flows as the business has moved past peak capex spend on full fibre. Another new holding is Breedon Group, a vertically integrated construction materials group operating in GB, Ireland and now the US. The business is highly cash generative and has delivered consistent returns through a combination of organic growth and M&A.

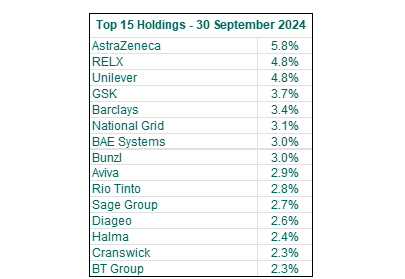

BAE Systems slides down the list after we took a significant profit from the holding. Low exposure to the Middle East conflict, a lengthy visible order book, the prospect of a forced settlement in the Ukrainian war (Trump presidency) and economic sector rotation out of industrials were among the drivers for this decision.

Bunzl and Unilever climb the list on the back of strong figures, which helped to offset the poorer performance from AstraZeneca. Food producer Cranswick appears in the list after more good figures propelled their shares higher along with the new holding in BT Group.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?