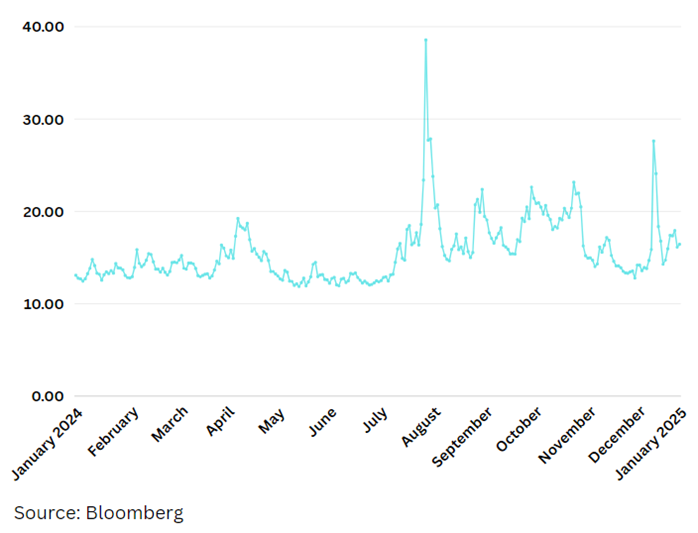

A brief bout of volatility returned to global markets in December on the back of a ‘hawkish cut’ of 25bp from the Federal Reserve, accompanied by commentary from various FOMC members lowering expectations for the number of further rate cuts during 2025.

The VIX Volatility Index chart tells the story of a mostly placid year for US equities (now over 70% of the FTSE and MSCI global indices) with two spikes, that tapered-off quickly (right).

With the S&P currently trading just off all-time highs and confidence in the economic might of America marching on in 2025, one would be forgiven for complacency, but bond markets are painting a different picture right now. Who would have thought that in a year where all the major central banks cut rates and the longest duration equity assets (high growth Technology stocks) were so strong that the yield on 10-year treasuries would rise just short of 70bps to 4.6%, with Gilts and bunds following a similar path (Gilt yields are now higher than during the Truss/Kwarteng incident!)? At the headline level, equity investors are believing in the AI-driven tech boom continuing, while fixed interest markets are taking a more sceptical view of the economy, nervous of persistently high inflation, global budget deficits and slowing growth outside of the US. We do not have the luxury of a crystal ball but would say that there appears to be a lot of enthusiasm priced-in to US equities here, so it would not be a surprise to see them disappoint over 2025.

To put some real money figures on the narrowness and circularity of the US market currently, the largest five businesses in the S&P 500 Index at year-end were:

1. Apple

2. Nvidia

3. Microsoft

4. Amazon

5. Alphabet

Climbing to number two in 2024, Nvidia has been a star performer both in terms of business performance and shareholder returns. Nvidia posted $60.9bn of revenue in FY24, more than doubling, and are expected to be close to $200bn by FY26 thanks to customers climbing over each other to get their hands on Nvidia’s super-powered chips. But who are Nvidia’s largest customers? Look at the other four names on the above list and add in Tesla, Meta and Oracle and that makes up the lion’s share. The US mega-cap tech sector has become so big that its growth is now being propped-up by itself – all well and good while the music keeps playing, but what if…

Against this backdrop, Esk continues to maintain a relatively lower weighting towards the Technology sector and always to focus on the highest quality names where we are owners of tech. For example, we have been investors in Microsoft, Apple and Alphabet (Google) for comfortably over a decade, while we continue to steer clear of Nvidia, Tesla and Meta. We have been steering new money towards less glamorous sectors in recent months such as Consumer Staples (Couche-Tard) and Healthcare (Straumann) and expect to continue to do so while current market conditions persist.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?