‘Extraordinary times require extraordinary action’ – Christine Lagarde.

Quite right, but at first the politician in her did not understand and at the regular European Central Bank (ECB) meeting she announced a paltry €120 billion of extra QE and stated ‘it was not her job to close spreads’: cue a collapse in BTP’s, OAT’s and Spanish paper, EURIBOR curve etc. Thankfully sense was seen and the ECB then announced a huge €750 billion PEPP, Pandemic Emergency Purchase Program, expanded the range of eligible assets, eased collateral standards for banks - even undertaking to buy Greek paper and stated there were no limits to what they will do.

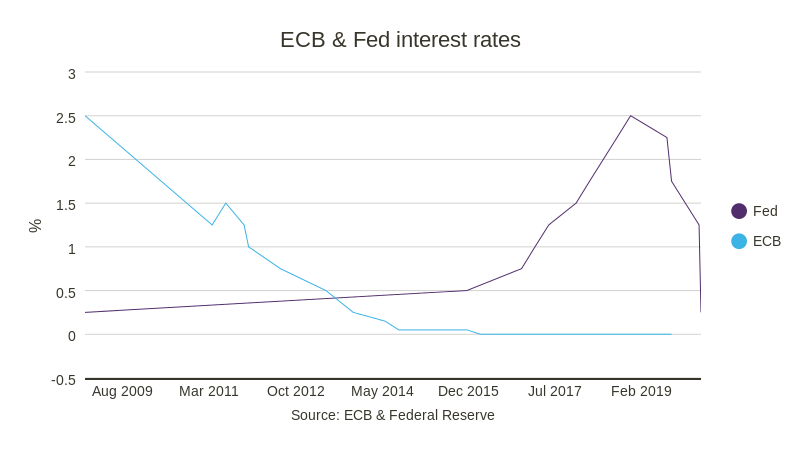

Meanwhile the Fed pulled out all the stops, cutting rates to just above zero which we know is pointless, this is not about the price of money but about liquidity, but it is the headline grabber. As the supply of dollars dried up swap lines were put in place with major central banks and then extended to minor CB’s. $500 billion of repos are now conducted every morning and afternoon, 2008 facilities were reinstated to unfreeze the $1.1 trillion Commercial Paper market which had forced the likes of Kraft Heinz to take up credit lines with banks and they restarted large scale asset purchases. They also created a new MMLF (money market mutual lending facility) to free up funds to meet redemptions. The six biggest US banks accessed the Feds Discount Window in a coordinated move to remove the normally associated stigma.

The Bank of England made headline grabbing cuts to the base rate and restarted the TFS (£100 billion) to allow banks to lend to SME’s, along with buying CP too, but more importantly announced an extra £200 billion of asset purchases - twice what was expected - and although this will be mainly Gilts, it will include corporates as well. This is bringing much needed stability to the Gilt market, which the new Governor pointed out was verging on disorderly, and to sterling assets including credit spreads.

The message we must take from all of this is that Central Banks are coordinating and really will do ‘whatever it takes’ to stop the coronavirus effect to the real economy precipitating a financial crisis which would only add to the economic damage that is with us. It is now over to Governments to provide the fiscal stimulus and support that is needed on an economic basis and at a social level. Our new UK Chancellor appears confident and capable and hopefully is up to the task. Across all developed countries we can look forward to unprecedented levels of sovereign issuance so debt ratios will undergo a seismic change.

The speed and intensity of recent moves across all asset classes have taken everyone by surprise, there is a case that these have been exacerbated and magnified by exchange traded structures, possibly due to another regulatory lack of oversight.

How would you like to share this?