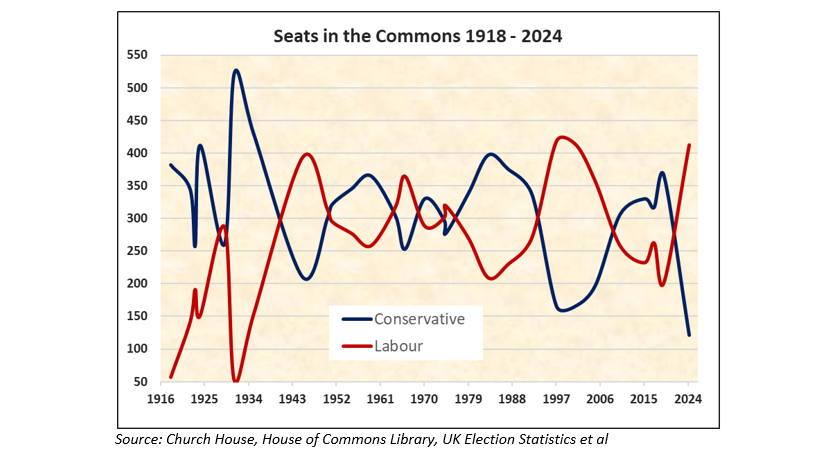

July was an extra-ordinary month in so many ways. Political upheavals commenced with the UK General Election: the change in Government was expected, the extent of the collapse in the Conservative Party vote perhaps not (see our footnote chart below, right).

In America, an attempt on the life of former President Trump was followed by the news that President Biden was to step down at the end of his term and the rapid promotion of Kamala Harris to Democratic candidate in the forthcoming Presidential Election. Kamala Harris has quickly broken fund-raising records and the US political landscape has been transformed, it is now anyone’s race, whither the ‘Trump Trade’?

Middle Eastern politics and strife took a further unpleasant turn. Will Benjamin Netanyahu feel emboldened by some recent assassination ‘successes’ and will a fading (lame duck) President Biden have the strength to stand up to him? Escalation here feels like a genuine risk at present. Most of the major commodity markets weakened, notably the price of oil along with copper and iron ore, with on-going weakness in the Chinese economy adding to the pressure on prices.

Inflation is still appearing to be benign and further indications of a slowing US economy are turning the Federal Reserve (and other central banks) more doveish. After last night’s Fed meeting a cut in US rates in September appears to be highly likely. Today, the Bank of England has moved to reduce rates by one quarter of one per cent. The odd man out here (as so often) is the Bank of Japan, which took one more small step to ‘normalisation’ with a hike in rates to 0.25%, cue a steep reversal in the USD/YEN exchange rate after another year of weakness for the yen.

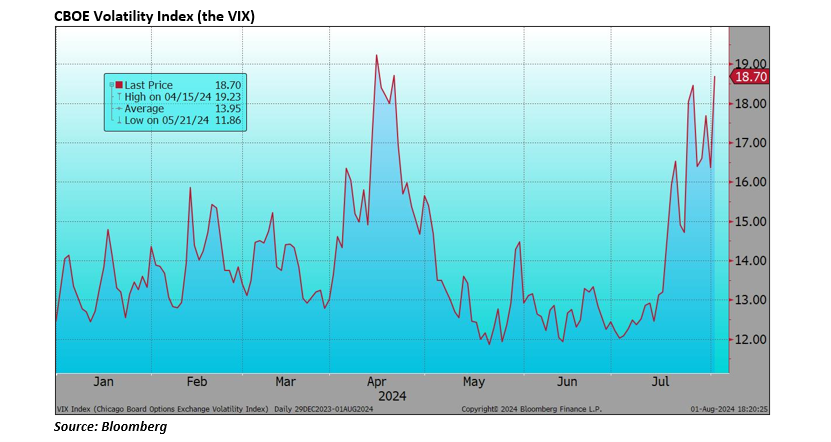

Bond markets also took their cue, both the UK ten-year Gilt yield and ten-year US Treasury yield have fallen below 4%, with accompanying gains for bond prices. In contrast, equity markets struggled with the S&P 500 showing a small gain and the NASDAQ a small loss as did the Euro Stoxx Index. But the calm at the index level disguises mounting intra-month volatility, particularly for the NASDAQ leaders and the VIX jumped (right).

Against this the Russell 2000 Index of smaller US companies had its best month for some while, gaining 10%. The much anticipated rotation out of the narrow group of major companies that have led markets for so long, into the broader market appears to be showing itself. The pattern in the UK was similar, if not so marked, with the mid and small cap indices outperforming the FTSE 100 Index.

This much volatility in stocks as we enter August, a month that is often difficult for equity markets with thin holiday trade and turbulent politics and geo-politics, does not appear to bode well in the short-term. Combined with the fact that the turn in rates has now arrived, this makes me feel that we have travelled far enough for now and a pause is in order for stocks.

Footnote

Tory Party woes… that was their lowest number of seats in the Commons for more than 100 years, this will take a while to recover:

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?