Shifting sands... In July, the UK shifted decisively to the left and elected a Labour government, this month the US shifted decisively to the right and elected Donald Trump with a sweeping majority (what on earth has gone wrong with the US opinion polling? They were completely wrong).

Now we watch political turmoil unfold in France and Germany.

Of course, the election of Donald Trump to another term as President brings with it all manner of uncertainty for the US and across a difficult geo-political canvas. For the moment, US equity markets have focussed on de-regulation and an ‘America first’ business-friendly environment, I wonder whether this carefree attitude will survive the new President’s inauguration.

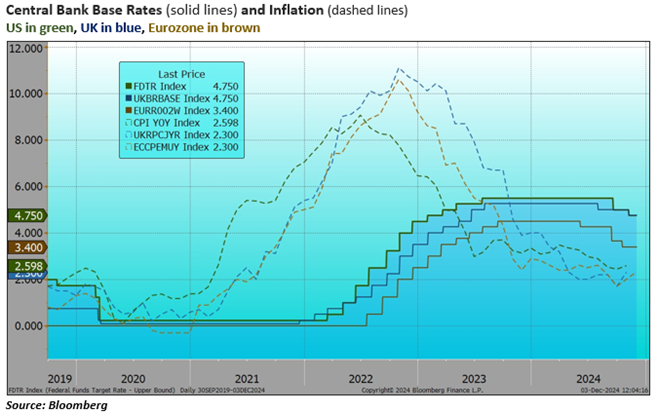

Focussing on what we know - Inflation has come back down close to the central banks’ targets, though it is now displaying more resilience than is comfortable and Trumpian policies are definitely being viewed as being inflationary. The next rate announcement from the European Central Bank (ECB) is due in a week or so and the Bank of England (Bank) and US Federal Reserve (Fed) are due to announce their decisions mid-month. Against a tricky economic backdrop, the ECB is expected to cut rates again, the decision for the Fed and the Bank is more nuanced, but on balance I would expect them both to cut rates by 25bp. If that is right, expect slower progress in 2025.

This chart, right, shows the current position and inter-play between inflation rates and central bank rates over the past five years.

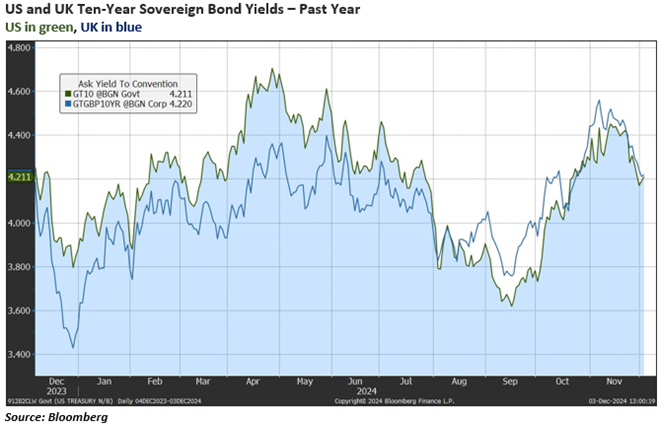

While US stocks have been celebrating the election of Donald Trump, the S&P 500 and the NASDAQ are both up by around 5% since 5th November, US bonds have not been so sure. Ten and thirty-year US Treasury yields moved up following the result, worrying about those inflationary policies (tariffs!) and the yawning budget deficit. But they have since re-traced the move on the back of reasonably encouraging inflation data and soothing commentary from Fed speakers. UK ten-year Gilt yields have moved increasingly in lockstep with US yields (see right). In Europe, yields are generally lower, the German ten-year bund yield is close to 2%, but French yields are struggling. The French ten-year yield at 2.9% is the same as Greece (that is quite a turnaround in fortunes) and higher than the Spanish and Portuguese equivalent.

US equity markets led the way and the ‘broadening out’ of performance picked-up again with an 11% gain for the Russell 2000 Index over November. The European markets were mixed with Germany ahead, led by SAP and Deutsch Telekom, while France was lower with LVMH, L’Oréal and TotalEnergies all down over the month. UK stocks were ahead by around 2% with strength in the financials and notable gains for BT, Sage, 3i, Halma and Melrose out-weighing falls for AstraZeneca, GSK and Shell.

The US financials leapt on the election result (that regulatory burden): Goldman Sachs gained 17% on the month with JPMorgan and Morgan Stanley close behind with gains of around 13%. The effect was not limited to the US, over here Barclays gained 11% and Standard Chartered 8%. The prize for the most extraordinary move goes to Tesla, which leapt an astonishing 38% on the result and consequent elevation of Elon Musk.

Amidst a daily onslaught of dire geo-political news and worries over the next bizarre Trump appointee let’s not forget that, looking back to the beginning of the year, a number of uncertainties have actually been resolved. The UK and US elections have provided clear outcomes (there is unlikely to be any problem with the January hand-over to President Trump), inflation has come back down to manageable levels and the central banks have generally shifted to a rate-cutting cycle. Then take a deep breath and go and take a look at quite how cheap so many UK companies are…

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?