The litany of events clamouring for attention over the course of the first half of the year has been startling.

From the perspective of market volatility, it was President Trump’s extraordinary ‘liberation day’ pronouncements on trade and tariffs that set the tone and market turmoil ensued. But that hit some bond market buffers and then the TACO* trade kicked in, and stocks rallied hard despite war between Israel and Iran and the steady descent of Gaza into a hell-on-earth. The chaotic tariff ‘negotiations’ are, of course, due to return to centre stage next week. Most notable at present is the slide in the US dollar, which sank by almost 11% on its index v. major currencies, and that at a time when one would normally expect the dollar to be a ‘safe haven’.

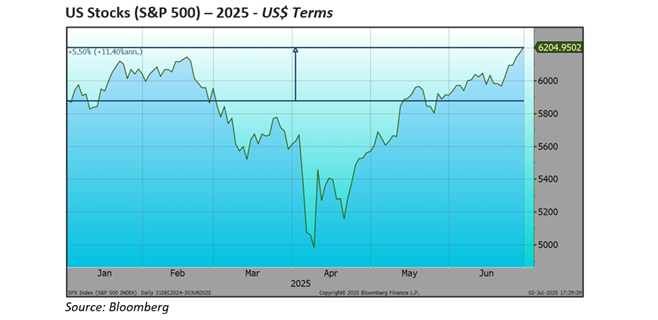

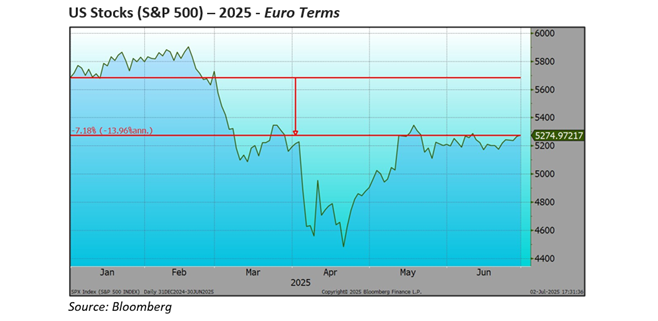

So, US stocks closed the half-year up 5.5% after being down 18% at one point in early April. But that sliding dollar means that UK investors have seen a fall of 4% in the value of their US investments and rather more from the perspective of European investors.

That US stocks gain (right):

Does not look so good when converted to euros (below, right):

The central banks have been cutting their rates, albeit that American rates are not coming down anything like fast enough for The President’s liking. The European Central Bank (ECB) has led the way with four cuts over the first half, back down to 2% again, where it appears that the ECB would like to hold. With the euro being the principal beneficiary of US dollar weakness there might well be pressure for more cuts to avoid choking off the nascent European recovery. Meanwhile the Swiss are back down to zero again…

The Federal Reserve has not made a move since December (holding at 4.5%) torn between concerns for a tariff induced rebound in inflation and softening labour markets. Once again, Jerome Powell, Federal Reserve Chairman, is coming under political pressure to move. US Treasury Secretary, Scott Bessent, says that his concern is with US ten-year rates, which have edged lower (4.25% at end-June), but it has been choppy with concerns for overseas demand for US debt. Easing of US bank regulations and support for ‘stable coins’ does seem likely to improve US domestic demand for Treasury Bills and short-dated paper. Long-bond rates look quite stuck around 4.8%.

The Bank of England has cautiously undertaken two quarter-point cuts to 4.25% over the year but does appear to be quite stuck in the headlights at the moment. Our ten-year rates have been vacillating between 4.5% and 4.7% for most of the year and seemed to be edging lower, but now we have the unedifying sight of PM Starmer losing control of the Parliamentary Labour Party and the Chancellor in tears at the dispatch box. It would not be good to see the ‘fiscal rules’ in doubt already.

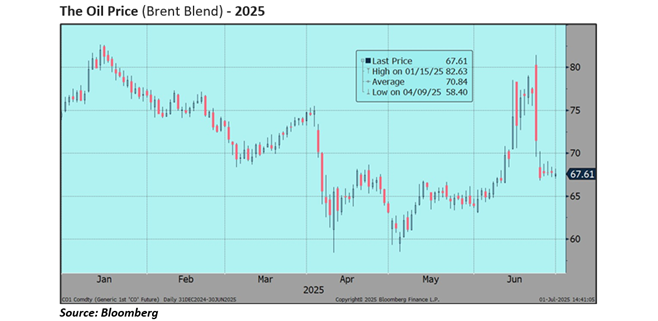

The price of oil has been a bit of a silver lining for world markets, slipping by around 10% over the six months. Its inability to hold any rally during the height of recent Middle East hostilities was striking (bottom chart, right).

Attempting to forecast the President’s next move in tariffs, geo-politics or domestic budget issues is clearly a mug’s game. I wonder what happened to the DOGE and the $2trn of spending cuts that it was going to find, that has all gone rather quiet after the demise of Elon Musk’s political escapade (who knows, maybe he’ll be back). The US and World economy has, so far, managed to muddle through rather well despite all the noise and maybe this remains as the most likely outcome.

But I do have a niggling worry that amidst all the concern for the (existential) risks of erratic policy making we might be missing the risk of a straightforward economic slowdown. Companies appear to have managed their inventory well over the course of the first round of tariff concerns but now we hear more grumbles as to what next and more lay-offs to come (Microsoft has just announced a second round of cuts, aiming to lay-off 9000 workers). US Government debt levels are downright scary and, while Europe appears to be much better placed now, that weak dollar is not helping.

*TACO = Trump always chickens out

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?