After a 30% rally in US stocks, they are not so clearly cheap now, but it has been good to see the volatility easing off again.

The date of the last of these commentaries, 17 March, turns out to have been within a whisker of the low for the S&P 500 (it was actually the following Monday 23). We can’t claim to have ‘called a bottom’, we don’t make those sort of statements, and continue with the view that it is fruitless attempting to call short-term market moves. Frankly, they could go anywhere in such an emotional climate, as witness the market for oil. We did state the view that some expensive markets (practically all sovereign debt, notably that with any duration) have got even more expensive, while other expensive markets, such as US equities, credit markets (quality only), had flipped to looking cheap again.

Stock markets did appear to be settling into a more rational frame of mind over the past few weeks with a rather clearer focus on the long-term winners and losers from the current crisis. Economists are sounding gloomy (as is the BBC), the IMF having recently declared that the Great Lockdown Recession will likely be worse than the Great Depression; in reality they are as much in the dark as the rest of us. What we are seeing is some colossal dispersion in ratings and performance of the various sectors and stocks. Obvious examples being Amazon.Com, now up by 25% over the year, and Netflix, up by 34%; contrast these with Exxon Mobil Corp down 40% and Wells Fargo by 50%.

The collapse in the oil price has been widely reported. Increasing production at a time when demand was shrinking rapidly appears to have been a colossal tactical error by Saudi Arabia (unless their aim was the destruction of the US shale oil industry). The late addition of the realisation that short-dated oil contract prices could go negative (combined with more disarray in ETFs) triggered panic.

The credit markets (re)opened for business in the latter part of March, encouraged by the strenuous efforts of the US Federal Reserve, ECB and other central banks. Credit spreads found support around the same time and corporates are able to raise funds, a significant comfort for equity markets. As Jerry Wharton, joint CIO, puts it: “A month on from the announcement of ‘QE infinity’ by the Federal Reserve and capital markets have stabilised and are functioning. There are still stresses and strains but, collectively, the Central Bank and Government programs enacted have produced an environment in which companies can refinance.” The ‘risk free’ ten-year gilt yield has stabilised around 30 basis points and the US around 60 basis points.

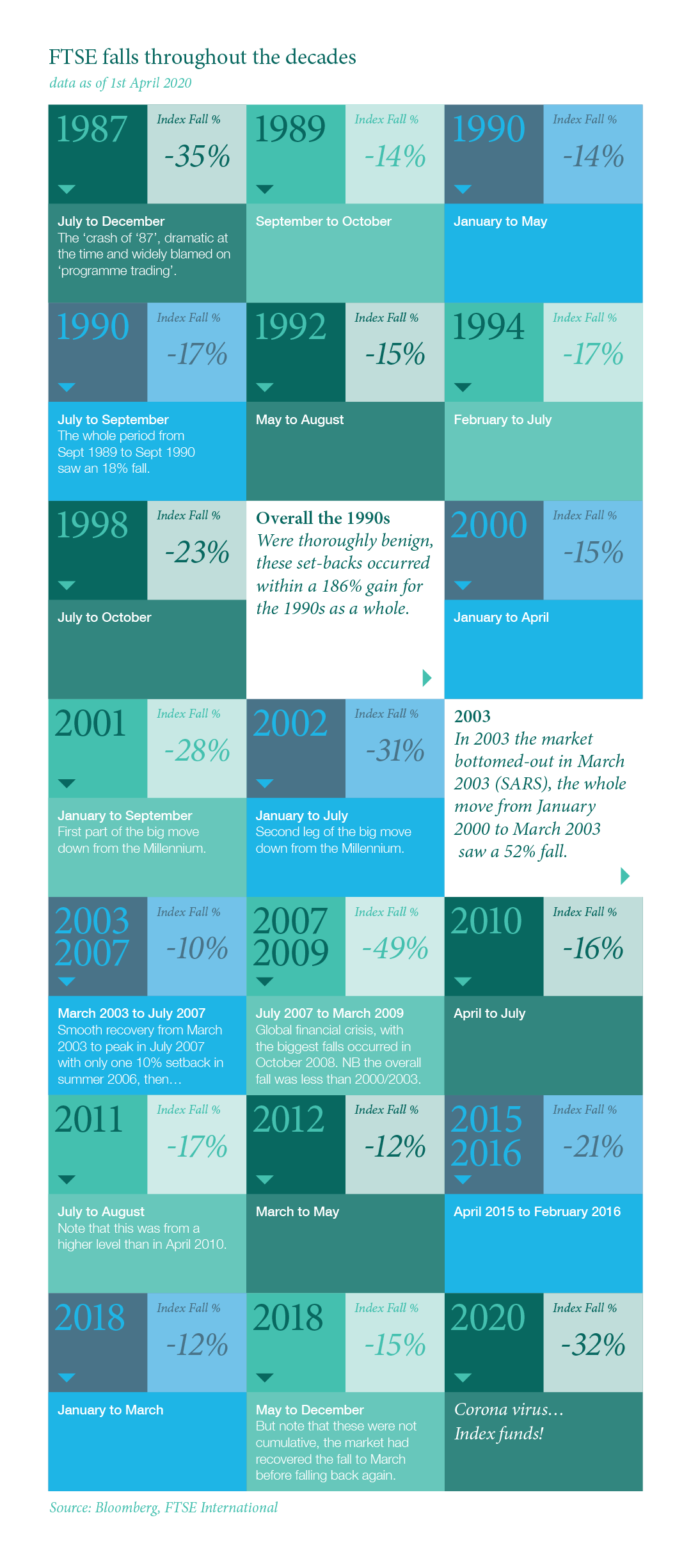

Footnote: the rout in stock prices in February/March did eclipse the October 1987 fall, just, (between October and November 1987, UK stocks fell 34%): between 12th February and 16th March, UK stocks fell 35%.

How would you like to share this?