Base rates have carried on up, led by the US Federal Reserve, with the ECB still playing catch up. Ten-year yields in America are steady but they are rising again in the UK and Europe, concerned about sticky inflation, which has fallen again in the US but remains stubbornly high in the UK.

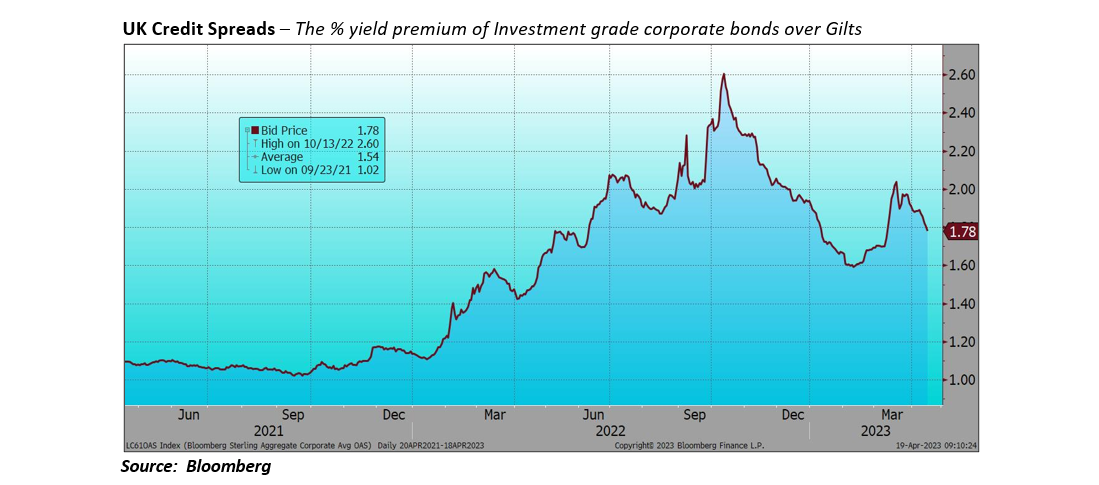

The ‘banking crisis’ has faded into the background somewhat but the impact will be felt in the availability of credit. Corporate credit spreads that spiked out again during the crisis are closing back in again (right).

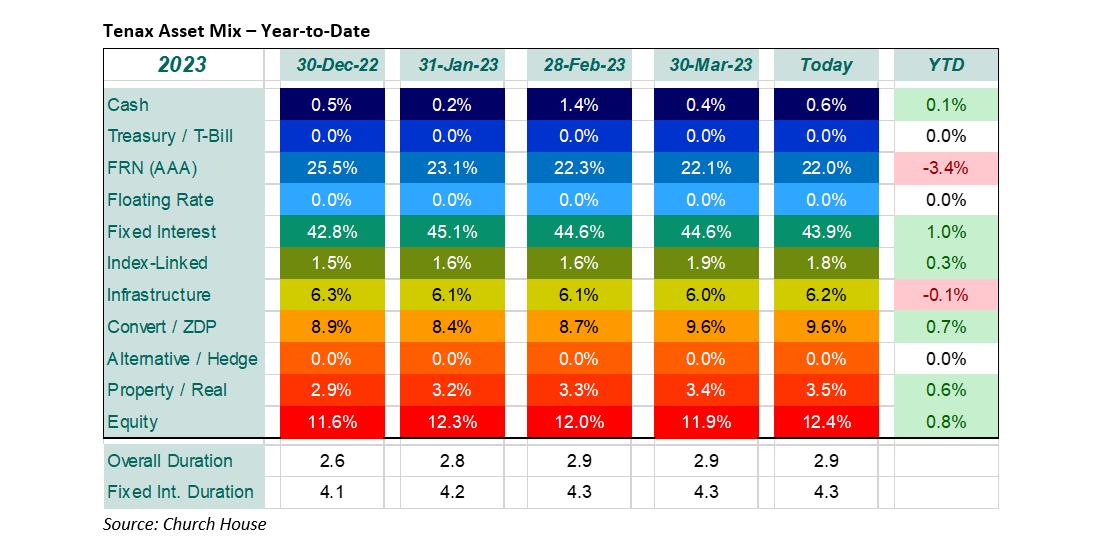

Within the Fund we have continued with the gradual shift from floating to fixed rate, still focussed on the short-dated end. We have also included a note of the overall duration and of the fixed interest proportion, which shows a modest increase, largely reflecting the shift to dated bonds (right, below).

The infrastructure sector has had a rough month in the wake of further mark-downs in asset values (reflecting higher discount rates) and uncertain financing (that banking crisis). The resultant selling from private investors no longer being balanced with professional buying as so many institutions have scaled-back their interest in the area thanks to the PRIIPs regulations. Something that has left much of the closed end / investment trust area of the UK market under a cloud. We are happy with the quality and resilience of our holdings in this area, which have generally outperformed the sector over the month.

Our equity holdings in banks snapped back over this period, notably Barclays, which gained around 14% and we took a quick profit on the holding in Morgan Stanley that we had acquired last month. The equity holdings all benefited the Fund over the period, which saw good gains for equity markets generally.

The problems in the banking sector have added to constraints in credit at a time when demand for borrowing is slipping back (hardly surprising given the move in borrowing costs). In turn, this must reduce pressure on central banks to keep raising base lending rates, we expect a few more modest increases, but that ‘terminal rates’ are in sight.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?