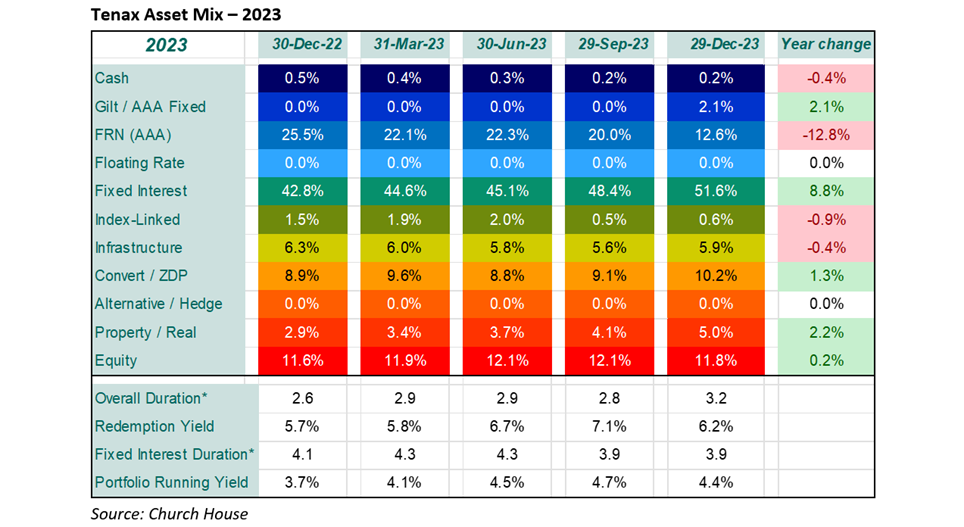

After another tumultuous year, though one that ended on a much brighter note, we commence with a look at movements in the Fund’s asset mix over 2023, right.

The big change has been the halving in exposure to floating rate notes (FRN) over the year, a move that we accelerated over the final quarter, assisted by the significant weakness in fixed interest markets in October. The principal beneficiary being Fixed Interest (credit/corporate fixed interest) along with some AAA-rated Fixed Interest. As we have said many times, we consider that it is definitely time for a switch from floating to fixed rate instruments after the massive increase in short rates over the past two years.

Property and Convertibles have also been a beneficiary, convertibles more than is apparent from these figures as the proportion in ZDP (zero dividend preference) has been reducing from sale and maturity of this (shrinking) area of the market. The recent recovery in commercial property stocks is welcome and overdue in our view as the sector was looking unreasonably depressed. Equity exposure is little changed as we have tended to reduce here in favour of the credit markets, which, for Tenax, look a more attractive option at present.

The duration and yield figures show an edging-up in the overall duration, which is a result of the reduction in the FRN exposure (floating rate notes have negligible duration) not a change in policy. The overall redemption yield still looks attractive at 6.2% for such a short-dated (and short duration) book.

We did see some good new issues before the primary market went to sleep over the Christmas period. We bought into an issue from Aviva of new 6.875% stock callable in 2033, a similar new issue from Phoenix of 7.75% stock also callable in 2033 and a new AAA rated issue from New York Life of 4.95% stock due in 2029. In the opposite direction, we reduced our exposure to Rothesay Life 5% in mid-December feeling that the rally was reaching a high. Indeed we do feel that in the short-term the move in rates has gone far enough, leaving little room for disappointment at a time when European inflation rates will tick back up again slightly, though, hopefully, this should be brief.

Naturally, we are pleased to see the Fund’s price back close to its September 2021 high after the ravages of 2022, notably that disastrous Truss administration (though it was mercifully short-lived). The big difference being that back in September 2021 the UK ten-year Gilt yield was 1% and, though we had the Fund’s duration down at 2.3, it was hard to see the opportunities. Now the ten-year Gilt yield is 3.7% and the opportunity set is plain to see.

*Duration represents the number of ‘periods’ that it will take to repay an initial investment in a fixed interest security. It is not the same as the life of the bond or time to maturity, which will be longer. It can also be viewed as a measure of the sensitivity of the price of a bond to a change in interest rates.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?