The first half of 2024 has seen respectable returns for equity markets while bond markets have essentially traded sideways after early falls.

The year of elections has produced another surprise (and an extra election) for France, now increasingly taking on the role of ‘sick man of Europe’. Our General Election is looking quite tame by comparison but, perhaps, that judgement should wait for the end of the week. Of course, then we await the big one in America, as President Biden produces a desperate performance in the ‘head-to-head’ debate with former President Trump and now the Supreme Court appears to have granted Presidents (and ex-Presidents) immunity from the law.

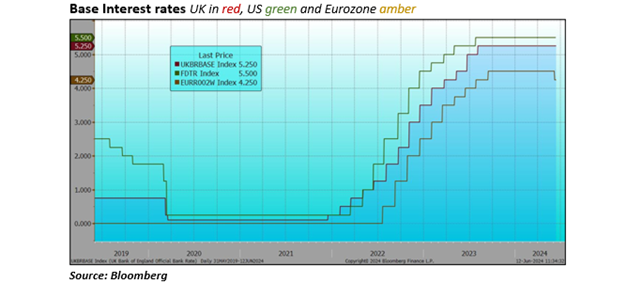

The central bank’s rates plateau is showing some sign of slippage as Canada and the EU have cut their rates – amazingly, the Swiss have just cut their rate to 1.25% from 1.5%, their peak rate was 1.75% (though they had started from a lower base of -0.75%).

A cut in the UK Base Rate looks likely later in the summer or early autumn absent a post-election shock. In America, Jerome Powell, Chairman of the US Federal Reserve, continues to maintain a steady hand and expectations for a cut have moved out to November time. But, of course, that would run into the Presidential Election so could also present a problem.

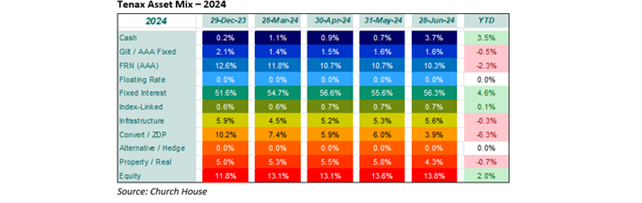

The greater proportion of the Fund’s portfolio continues to be invested at the short-dated end of the sterling bond markets but most of the recent activity has been in other areas. The proportion in commercial property (see Asset Mix table below) has fallen as we took the profit from our holding in Segro, still a good company but their share was rapidly catching up with their asset value unlike so many other property companies at present. The proportion invested in convertibles and zero dividend preference has also fallen again as the last of our ZDP issues reached maturity.

Within the equity proportion we have added a new holding in National Grid. National Grid announced a rights issue to raise around £7bn in late May to underpin their expansion programme. This was the largest rights issue in the market for quite a while and it really felt that the market did not quite know what to do as the stock moved ex-rights and a steep fall ensued. We felt that this was way overdone and we took the opportunity to build a holding.

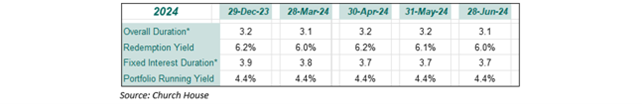

We still find the short-dated end of sterling bond markets particularly attractive and see little reason to be tempted longer. The bottom table shows the overall duration (still v low) and redemption yield of the bond proportions of the Fund’s portfolio, which currently account for 69% of the whole.

The Gilt market is still lower over the year, but we are enjoying robust interest returns from the whole of the bond proportion now. As we said earlier in the year, the Fund is benefitting from its multi-asset construction at present with better returns from the lower half of our Asset Mix table and we remain optimistic for the second half.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?