Our last report on activity in The Tenax Fund on 19th October coincided with the peak in ten-year interest rates in the US and Europe.

The UK was just past the peak of its rates problems in the wake of the disastrous Truss/Kwarteng mini budget and Prime Minister Truss was about to resign. Some order has been restored in the UK as we await a budget from the new administration and ten-year rates (3.2% down from 4.5% peak) are back below US rates at 3.7%.

The Federal Reserve, ECB and Bank of England all raised their base interest rates by 75bp over this period, amidst much debate as to how much further these might have to go and where terminal rates are likely to be. US inflation figures for October brought some cheer with a below estimate 7.7% on the CPI, the fourth month of lower figures since the peak of 9.1% in June. The UK has yet to peak though today’s 11.1% CPI may prove to be the peak, to quote Kallum Pickering at Berenberg:

“UK consumer prices surged by 11.1% yoy in October, up strongly from the 10.1% rise in September. Bloomberg consensus had only expected an increase to 10.7% – in line with our own call. With inflation already at a four-decade high, the upside surprise is concerning. However, the jump is largely the result of the uprating of the household energy price cap in October. Core inflation moved sideways at 6.5% yoy while annual producer price rises continued to roll over. With any luck, the October print is the peak for UK inflation. From 9% for the year overall in 2022, we expect inflation to fall to 5.3% in 2023 and 1.6% in 2024 before rising again thereafter.”

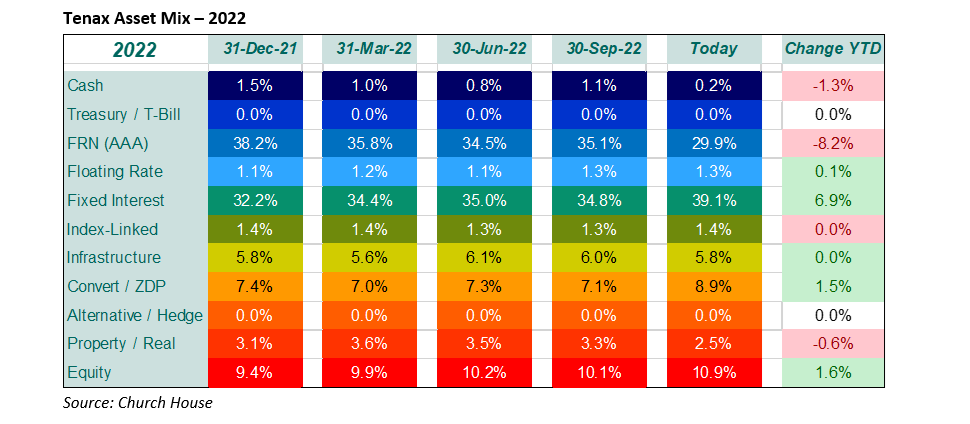

The Fund has recovered over the past four weeks, and we have been using the volatility to accelerate the shift in the balance of the portfolio, taking advantage of opportunities across risk assets, as shown on the right.

Most noticeable in the table is the accelerated fall in the proportion in Floating Rate Notes (FRN), now slipping below 30% of the portfolio. Yields on the FRN book continue to move up with the Base Rate (currently the FRNs yield 3.2% and will reach 3.5% shortly). We have continued to reduce/sell holdings from the big banks, Barclays, Royal Bank of Canada, and Santander UK. After the jump in credit spreads last month, we have increased Fixed Interest exposure, notable have been recent issues from NatWest Markets and Santander UK, both short-dated on redemption yields of 6.4% and 7.1% respectively. The duration of the fixed interest holdings remains short at 3.9, overall duration (including FRNs) is 2.3.

Convertible exposure is higher following the addition of a new bond convertible into Primary Health Properties (PHP). We also acquired an equity holding in PHP, both following a meeting with their Finance Director, PHP has suffered along with the commercial property sector generally, we like their unique assets and long-term record. Elsewhere in Property, we did sell the small holding in Grainger, preferring the commercial property market to residential.

Within the Infrastructure area, we closed the small remaining position in Triple Point Energy and took some profit from the holding in Gresham House Energy Storage, which had moved to a significant premium to underlying assets. We added modestly to Equity exposure again, increasing the holding in Schroders and significantly increasing the weighting in Investor AB. AstraZeneca has had a good year and we took the opportunity of further strength in their share price, following strong Q3 figures to reduce the holding.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?