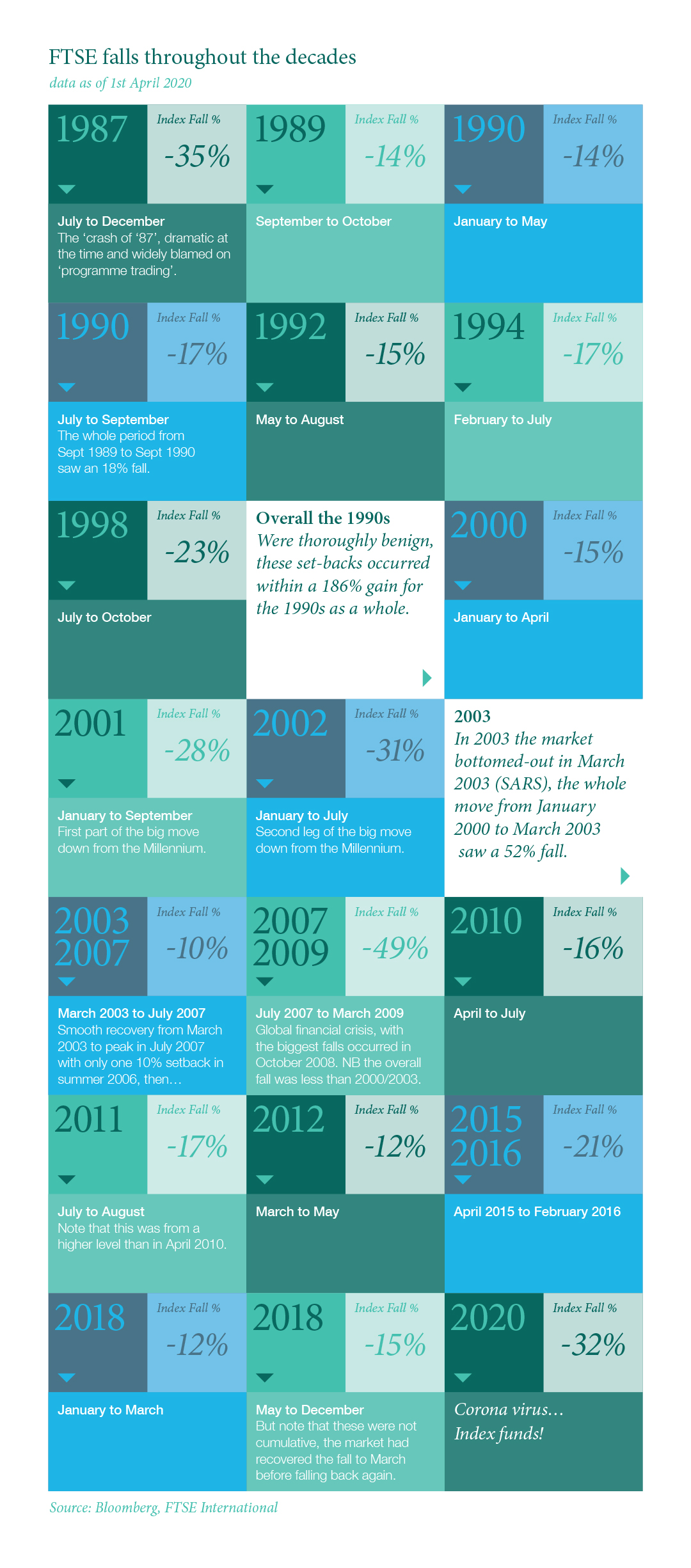

After coming perilously close to hitting all-time highs in January, the FTSE 100 took a substantial hit, falling almost 15% from January peak to end of February’s trough.

Coronavirus has hit global markets hard and presents investors with a novel challenge when looking at the year ahead. The CEO of recruitment company Robert Walters recently summed up the current economic situation succinctly:

“We’ve been through downturns and banking crises and political uncertainty and trade wars … but nothing quite like this incident, this is affecting everywhere in the world.”

We are still far from knowing what the human cost of the coronavrus outbreak will be, let alone the economic, political and wider repercussions. By nature, we all dislike uncertainty and investors have reacted by substantially marking-down share prices and their growth expectations for the year ahead.

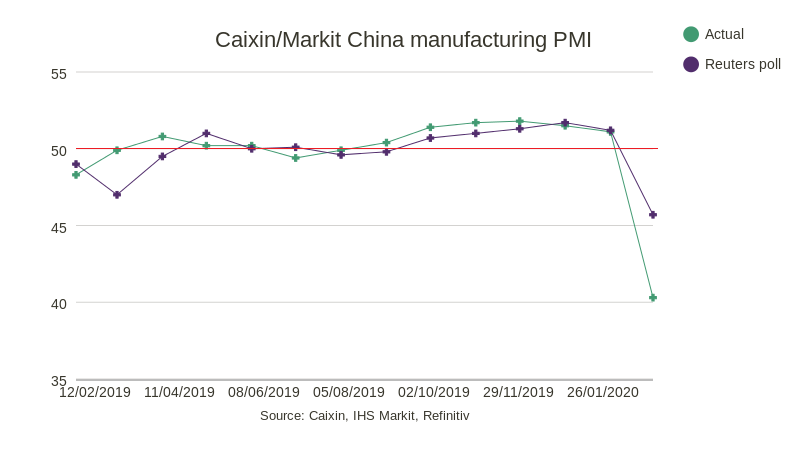

The negative economic effect of the coronavirus is clear to see in cancelled events, empty airports and closed factories. The Caixin/Markit China Manufacturing PMI numbers released earlier this week paint a bleak picture, with a reading of 40.3 – the lowest ever recorded (see chart, right). A reading above 50 indicates expansion, while below 50 indicates contraction.

As would be expected, the worst hit sectors in the UK market are the likes of airliners and hospitality companies, however the negative sentiment has been widespread.

History tells us that periods of universal negativity and relatively indiscriminate selling of equities can present some great opportunities to stock pickers who are prepared to be brave and to take a long-term view.

This feels like such a period and, while we do not pretend to know when coronavirus will be contained, we are confident that leading London-listed businesses we invest in, such as RELX, Compass Group and InterContinental Hotels, will outlast the virus and remain global leaders in their fields. We have been putting cash to work recently and will continue to do so where we believe that outstanding businesses have been oversold.

How would you like to share this?