Just as the markets were unshackled from the uncertainty of Brexit and the UK stock market was unleashed, the coronavirus appeared from Wuhan, China, the ‘Boris Bounce’ was firmly stopped in its tracks and we are back to early 2019 levels.

Much of the FTSE 250 stocks that particularly enjoyed the bounce sold off and, although we are optimistic about UK domestic businesses as a whole, the best place to be in this current, coronavirus dominated environment, is in companies with high-quality characteristics, regardless of their market capitalisation.

We define companies with high quality as those with high barriers to entry, strong fundamentals and recurring revenue generation. These main characteristics set the quality companies apart from their value and momentum screened peers.

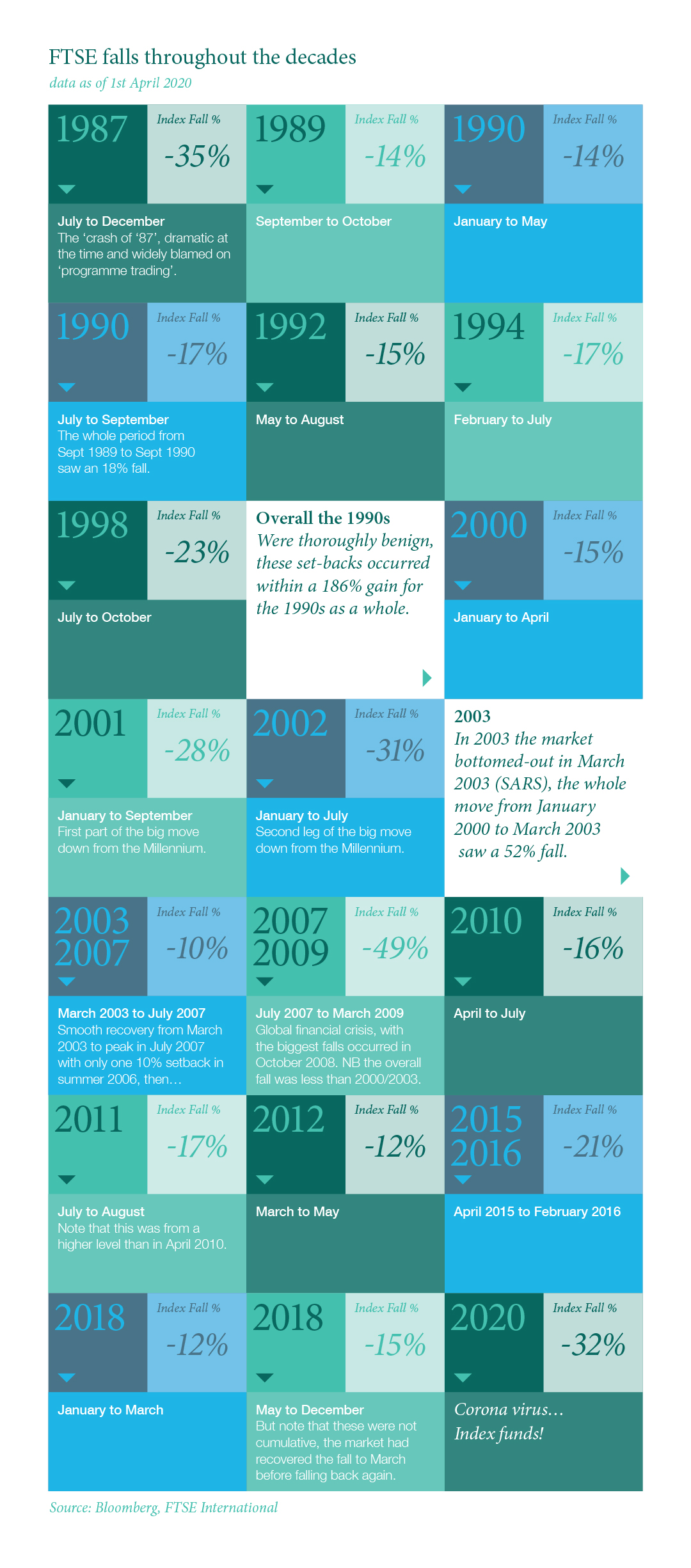

These ‘best-in-class’ characteristics have performed strongly over the past decade, where the value in their IP, brands and core specialisms have driven earnings over the long-term but have also offered protection during periods of significant market volatility.

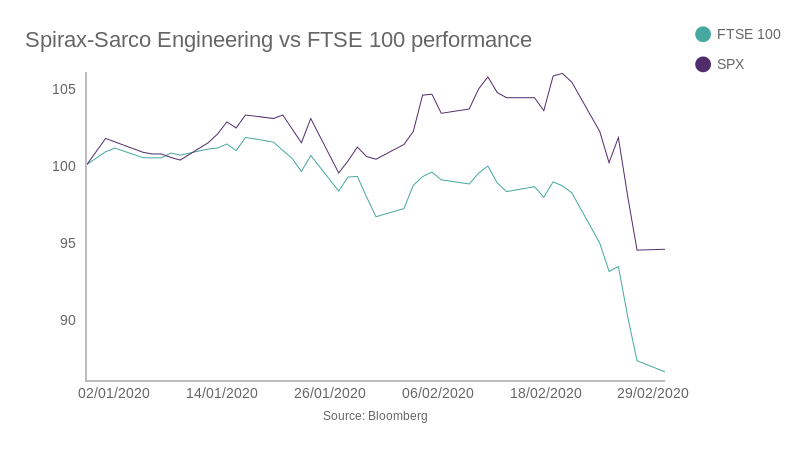

One such example is Cheltenham based Spirax-Sarco Engineering. It is the market leader in steam engineering and peristaltic pumps which are utilised across every industry and sector, with over 50% of group revenue derived from defensive, less cyclical markets. For example, over 50% of Nestlé’s energy use is steam derived, which is used in processes from energy control and power to manufacturing and cleaning.

Additionally, its pumps have end-uses ranging from heart by-passes to McFlurry machines in McDonald’s. Over 2008/2009, the company’s shares proved resilient, maintaining margin and raising the dividend throughout.

This type of company should be a staple of every portfolio and Spirax-Sarco has been steadfast in the top ten holdings of Church House’s UK Equity Growth Fund, and one we will continue to hold and add to.

Companies with the ability to scale and compound high returns over many years deserve a premium and, although they are often more expensive than average, when there is systematic risk affecting the markets they should be picked up at a reasonable price and hopefully continue to grow for years to come.

This article first appeared in Portfolio Adviser online.

How would you like to share this?