Markets for smaller companies on both sides of the Atlantic remained patchy at best in April as investor confidence has not returned to this segment yet.

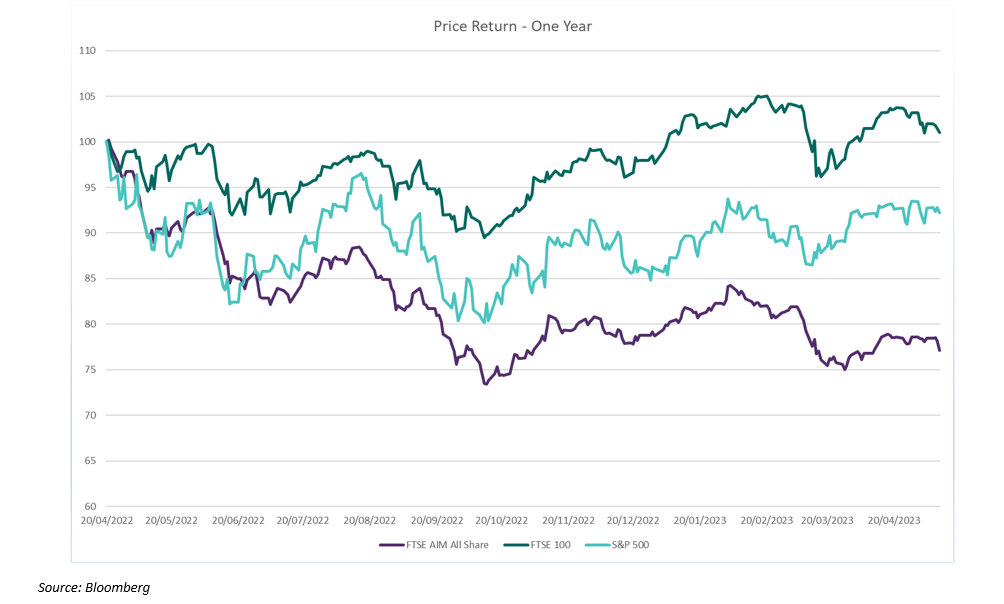

Year-to-date the FTSE Small Cap Index is flat, the AIM All Share is -2.1% and the Russell 2000 is -0.8% (all in local currencies) vs the large cap FTSE 100 +3.2%, S&P 500 +7.1% and Nasdaq leading the pack at +17.3%. Investors may have begun to dip their toes back into risk assets after a chastening 2022, but for the time being this is very much in the comparatively calm waters of blue-chip names. This is only to be expected and it will take time for investors to remember that there are in fact some excellent businesses, with far higher growth potential, trading further down the market cap spectrum. There are of course, some shockers to be avoided also in the small caps, so ignore a balance sheet at one’s peril!!

In the meantime, we have had the opportunity to put new money to work across UK small cap and AIM markets in businesses that we have admired for years and that have (in some cases) never traded on such low valuations. Take Fuller Smith & Turner (Fuller’s) for example – the pub company is currently trading at a discount of over 50% to the book value of their prime London (and southern England) estate. Yes, the business is faced with higher costs this year, staff shortages and low consumer confidence, but isn’t that exactly when we all need a pint the most?! Throw in the Coronation, the Lionesses vs the World this summer, the Rugby World Cup in September, and the return of tourists to London and one remembers that things could be looking up for Fuller’s. We have been adding to our positions in both Fuller’s and Young’s this year.

During April, we exited our disappointing investment in RWS after one profit warning too many and switched out of Liontrust into Rathbones. We feel that Rathbones’ private clients provide a longer-term and less volatile asset base to grow the business on than Liontrust’s more institutional exposure. We also added to our position in Ergomed, the provider of outsourced services to the pharmaceutical sector. This is a high-quality business that continues to grow at a handsome rate.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?