The term ‘yield curve’ has been in the financial press lately, most commonly with reference to the US Treasury market.

While the yield curve is not typically understood by investors, it is one of the key indicators of the economy and is relevant to inflation, interest rates, and the direction of the financial markets.

So what is the yield curve, and how can it affect your finances?

A Brief Guide to the Yield Curve

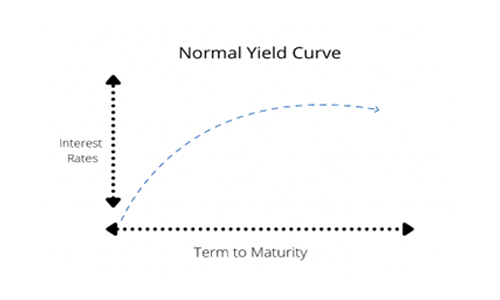

A yield curve plots the interest rates available from bonds depending on their duration, as shown in the example across.

Generally, the longer the term of the bond, the higher the interest yield. Investors expect to be rewarded for committing funds for the longer term. The longer the term of the bond, the greater the chance that the borrower will default, which increases the risk.

The yield curve can refer to any bond market and is a useful indicator of how the economy is doing and how it is predicted to change.

What Can the Yield Curve Tell Us?

The shape of the yield curve can tell us several things about the economic climate.

The aforementioned diagram above shows a normal yield curve, with interest rates steadily rising as bond durations increase. This indicates that the market expects moderate growth and reasonable availability of credit. This represents a thriving economy, with no major concerns predicted.

If the yield curve steepens, this means that the yield on longer-term bonds is increasing at a disproportionate rate compared with shorter-term bonds. This usually happens when the economy is starting to expand following a period of contraction. Inflation and growth are predicted to rise, which means that longer-term bond investors demand a higher rate for committing funds.

A flattened yield curve means that longer-term interest rates are similar to, or slightly higher than, shorter-term yields. This suggests economic pessimism, as bond investors are willing to accept a low bond yield for long-term investments rather than investing in equity markets. A flat yield curve can tell us that the economy is slowing down.

In some cases, the yield curve actually becomes inverted, which means that longer-term yields are lower than shorter-term yields. This not only indicates that longer- term investors are willing to accept lower rates but are actually looking to lock in those rates as they think they will fall further. An inverted yield curve can suggest that a recession is on the way.

The yield curve is not only relevant to the bond market. The more attractive it is to invest in bonds, particularly over the longer term, the less appealing it is to invest in equities. This can impact share prices and, therefore, the value of investments.

Factors that Affect the Yield Curve

Currently, the yield curve is inverted. This is on the back of rising inflation and tightened monetary policy as central banks moved to increase interest rates. This suggests that the economy will slow down.

In general, bond rates, and therefore the shape of the yield curve, are influenced by the following factors:

- Inflation

- Interest rates and whether they are rising or falling

- Equity markets

- Demand for borrowing

- Predictions over economic growth

What to Do When the Yield Curve Changes

Analysts and investors closely watch the yield curve, as this is an indicator of the wider economy. When it changes abruptly, this can send financial markets into turmoil as investors try to re-position their assets. If the yield curve suggests that growth is slowing down or we are entering a recession, this can cause equity prices to fall, which creates a drop in the market.

The key point to understand is that the economy is cyclical, and everything is interlinked. While a flattening yield curve can indicate pessimism, it also makes it more attractive to invest in dividend-yielding stocks. As share prices drop, investors may be more inclined to invest in companies they feel are undervalued. The economy cannot contract indefinitely and will always balance out eventually.

When you invest, you have to accept that normal market conditions, where prices and values rise at a steady pace, are not necessarily the norm. We know that investments will rise and fall, the economy will expand and contract, and that sometimes we might lose money.

The secret to investing successfully is not trying to avoid volatile markets. This would be impossible. There are too many variables, and things change too quickly. Taking the example of the yield curve, this is publicly available and widely scrutinised. If you were to change your investments when the yield curve fluctuated, you would already be too late.

The best strategy is to realise that market volatility happens sometimes and to stay invested anyway. You will see some dips, but providing your portfolio is suitably diversified, it’s likely to increase over the longer term. The periods of recovery that follow a market fall are instrumental in terms of a successful investment plan.

Important information

The contents of this article are for information purposes only and do not constitute advice or a personal recommendation. Investors are advised to seek professional advice before entering into any investment arrangements.

Please also note that the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?