After the mildest of recessions, our economy appears to have returned to a gentle growth path.

Assuming it is correct that the inflation figures will show a noticeable turn for the better over the next few months and the Bank does make a start at reducing the Base Rate, we should see something of a tail wind to this improvement. Of course, there does remain a residual risk that the Bank waits too long before making a move. At their most recent meeting, the Bank’s Monetary Policy Committee maintained the Base Rate at 5.25%, as expected, but the votes of the members are now much more in balance with eight voting to hold and one to cut rates.

After a wobbly start, London stocks picked-up in March to show a positive return for the first quarter for larger companies. As with so much of last year, smaller companies under-performed, leaving the AIM Index down by around 3% so far.

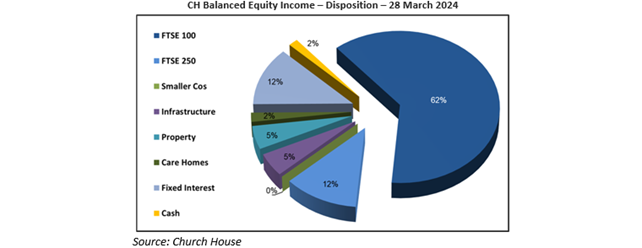

The Balanced Equity Income portfolio showed a modest gain over this first quarter. The overall disposition being broadly similar to the end of 2023 with the majority of the portfolio invested in major UK companies:

Packaging company DS Smith received an ‘indication of interest’ from UK rival Mondi in early February; International Paper of the US has now stepped in with the prospect of a higher offer for the company. While it is good to see the increase in the stock price it would be a shame to see another UK company disappear.

Reckitt Benckiser has been a serial disappointer in recent years, dating back to their purchase of Mead Johnson in 2017. Our patience ran out at the end of March as a US court ordered Mead Johnson to pay compensation to the mother of a baby, which died after being fed one of their baby formulas, Enfamil, potentially opening the way to hundreds more such cases. I should add that Reckitt stands by the safety of its products and strongly disagrees with the jury’s decision. Nevertheless, we have sold the entire holding.

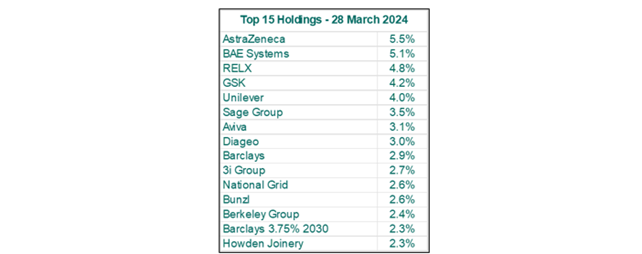

The banks have been notable positive contributors this time, Barclays has moved up the list of top holdings while Lloyds has also done well. The exception was Close Brothers, which fell sharply after the announcement of an FCA review into historical motor finance commissions. We sold the Close Bros holding, using the proceeds to add to Phoenix Group and to the fixed interest holding of Royal Bank of Canada 5% bonds due in 2028. The other most noticeable feature has been the strong recovery in GSK after they raised their guidance on profits on the back of buoyant vaccine sales.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?