The shock to the system that hit the markets at the end of February, steamrollered into March with the FTSE 100 index dropping like a stone and finally dipping below 5000 points (for the first time since May 2012), producing a peak-to-trough fall of 35% in 2020.

As we are in the midst of a nationwide lockdown, the long-term repercussions of COVID-19 are yet to show their hand, but the initial lockdown wave will lead to a substantial slowdown in economic activity, with many analysts suggesting in the region of -30%.

Hit hardest are the Airlines, Travel and Leisure industries. FlyBe was the earliest casualty, but restaurant chain Carluccio’s and retailer BrightHouse swiftly followed - many more are expected to come (and go). The airline Virgin Atlantic is on the cusp of asking for a bailout from the government. Companies will be hit hard and it could take a very long time to recover to the ‘normality’ of last month.

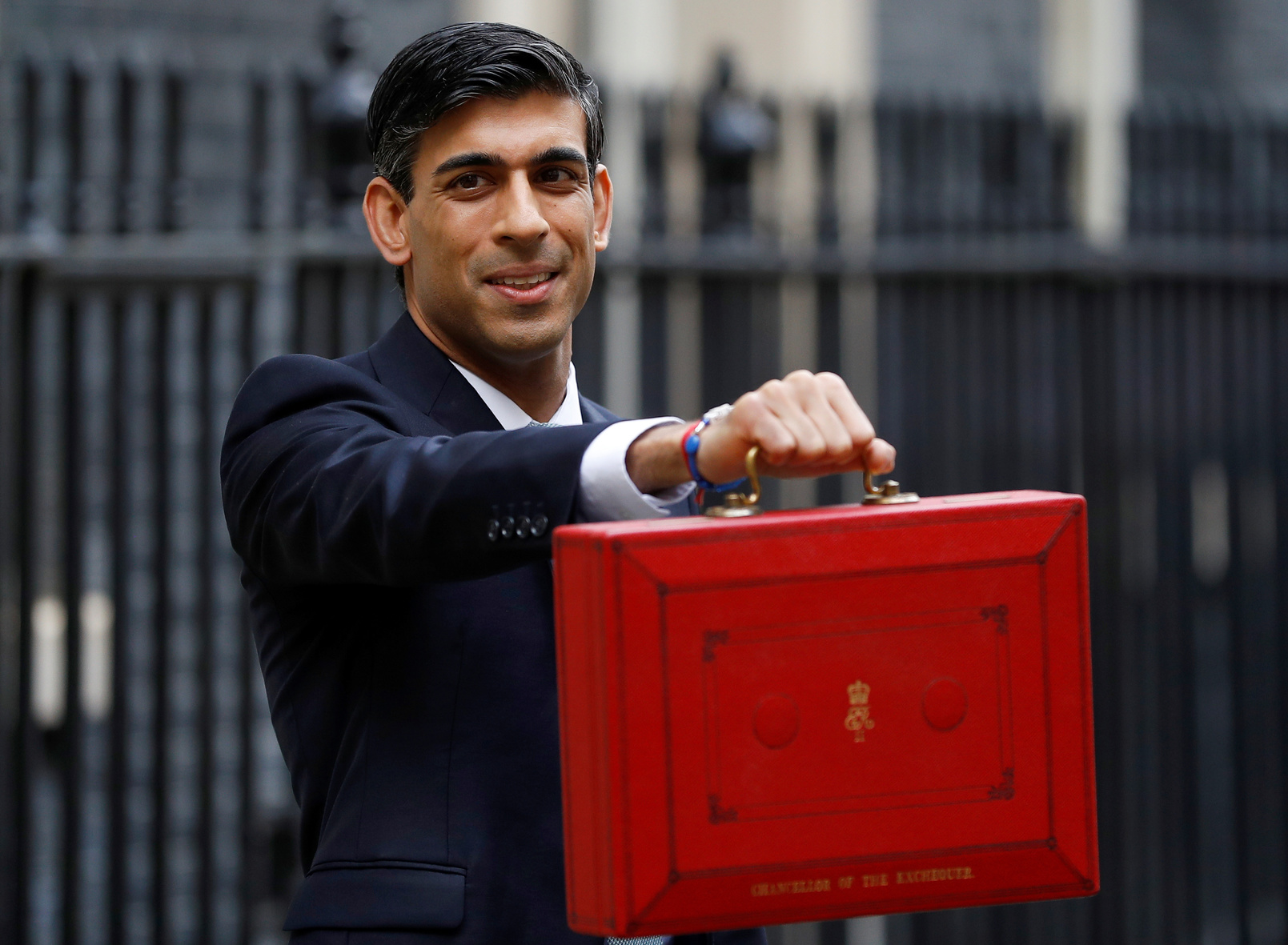

Attempting to mitigate this unprecedented economic slowdown, governments have been in lock-step with central banks and the world is in the midst of triage by policy. The Chancellor of the Exchequer, Rishi Sunak, in a masterly speech, delivered an unparalleled rescue package to the tune of £350 billion, going further than any government ever has done in peacetime to fight this economic emergency.

The long-term implications of this huge aid package are for discussion another day, but the supporting of jobs, incomes and businesses by the underwriting of 80% of salaries of furloughed employees and access to government-backed loans is impressively admirable.

At Church House, our focus is on quality. Investing for the long term in companies that operate in sectors with high barriers to entry, that produce strong returns on capital employed and have fundamentally strong balance sheets with excellent shareholder aligned management.

We cannot change the direction of the wind, but we can adjust the sails. We have used this as an opportunity to add to existing positions that came off and to initiate new holdings in companies we have long-admired and have been waiting for them to return to ‘fair valuations’. As Winston Churchill emphatically said, “never let a good crisis go to waste.” Stay home and stay safe.

How would you like to share this?