London stocks picked-up over the final quarter of the year though, for the year as a whole, they were laggards in an international context.

The US led the way, specifically the NASDAQ, while the ‘Magnificent Seven’ of leading US technology stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) outshone everything else. The fixed interest markets remained highly volatile but also gained over this quarter.

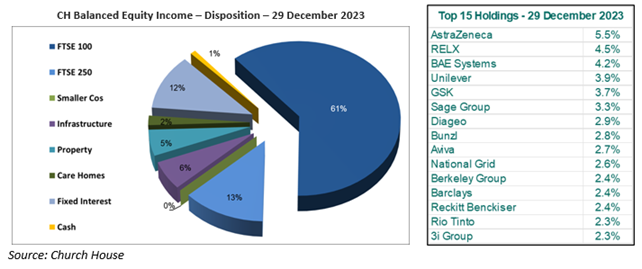

The Balanced Equity Income portfolio gained over the final quarter taking it to positive for the year as a whole. The dividend paid at the end of November was around 12.5% higher than last year’s payment, putting the ‘B’ income units on a historic yield of 3.8% at the end of December. The overall disposition shows little change though there were more transactions than usual this time, right.

Within the Fixed Interest portion of the portfolio, we have reduced the index-linked holdings in favour of fixed coupon where rates have been so attractive recently. We have sold the Heathrow index-linked 2039 and reduced the Treasury index-linked 2030 in favour of new holdings in Royal Bank of Canada 5% 2028 and Toyota 5.625% 2028 along with additions to the KBC Group 5.5% 2028. Within the equity holdings, we have made modest reductions to Halma and Sage Group. We still like both of these companies but Halma’s dividend yield below 1% makes it harder to hold in the Fund and the strong gains for Sage over the period took them to a level that called for some profit taking. In the opposite direction, we added to Phoenix Group, which was depressed for no clear reason and offers a high dividend yield.

We have also shuffled the property holdings to improve the dividend yield, selling Shaftesbury Capital in favour of additions to the Tritax Big Box and Primary Health Property holdings. The Top 15 are broadly similar to last time though Unilever drops down after dull performance as does Reckitt Benckiser. Sage edges up the list despite the reduction in the holding. Berkeley Group appears in the list after a strong period for the housebuilders (Bellway has also had a particularly good quarter). 3i Group appears in the list as their good run over the year continues on the back of good figures for their Action subsidiary.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?