The third quarter of the year has actually been dominated by the bond markets and the renewed increase in long-term interest rates.

This undermined equity markets everywhere, notably the NASDAQ, which had been providing leadership, in the US the S&P 500 fell by around 4% over the quarter. Hong Kong was the biggest casualty with a fall of around 6%, reflecting the on-going problems in Chinese property, Japan was the exception with a further modest gain to add to strong gains for the year (though continuing weakness in the Japanese yen undermines these returns for non-Japanese investors).

The Esk Global Equity Fund had a quiet quarter overall, dipping with world markets down, though it benefitted from the strength of the US dollar. The proportion invested in America has just crept over 50% after solid performance from some of the bigger holdings (Alphabet and Intuit were notable) and the addition of two new holdings in the US healthcare sector, Cencora and UnitedHealth Group.

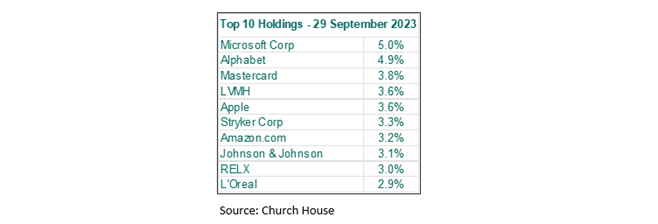

The top holdings are little changed though the positions have shuffled a touch. Alphabet was strong after their second quarter earnings report in July, and Mastercard were marginally ahead. These two knocked LVMH (Louis Vuitton etc.) back to fourth place after a rough quarter for the luxury goods companies, worrying about the Chinese non-recovery, which also knocked Hermès. None of this is apparent in LVMH’s figures, which showed double-digit revenue growth in all areas except for wines and spirits. This latter also being reflected in poor performance from Rémy Cointreau. Apple weakened as iPhone sales disappointed, and China banned their use by government officials, while Oracle fell back after their steep jump in June, they reported record revenues but a lacklustre outlook for their ‘cloud’ revenue growth. Intuit, the US accounting software company (QuickBooks etc.), provided a bright spot with strong performance over the period.

Among the healthcare names, GN Store Nord produced one ‘update’ on their profits too many for us and we sold the holding. Lonza Group fell back sharply as they announced the departure of their Chief Executive to be replaced, pro tem, by their Chairman Albert Baehny. We regard this as a positive move and have added to this holding. The two new US healthcare holdings, where we have established modest-sized initial holdings, are UnitedHealth Group, which organises and manages health plans for employers (including Medicare, Medicaid etc.), and Cencora (until recently, AmerisourceBergen), which is a distributor of pharmaceutical and over-the-counter healthcare products with close ties to Walgreens Boots Alliance.

Novozymes has slipped again this quarter, we await news of the proposed merger with Chr. Hansen Holdings, another Danish company, to see if this might provide a catalyst for some better performance. The financial holdings had a good quarter. The banks saw Sumitomo Mitsui Financial gain almost 20% while Nomura Holdings was also strong and Standard Chartered gained around 11%. The reinsurance companies were strong, Berkshire Hathaway and Swiss RE both gained but the feature was a 9% gain for Everest Group (formerly Everest RE).

*****************************************

Esk Objective and Policy

- Long-term capital growth

- From an international equity portfolio

- Actively managed portfolio of 40/50 holdings

- Strong bias to quality and growth

- Aim to buy-and-hold for the long-term

- Aware of 'benchmarks' - but do not follow them

- Developed markets only (Rule of Law)

A few things Esk does not do:

- No emerging market stocks

- No smaller companies

- No unquoted companies

- No 'un-profitable tech'

- No shorting...

- No 'regional' banks

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?