As we approach the year-end, we thought it would be helpful to make a few observations, in particular relating portfolio performance to something more meaningful than just the ‘white noise’ of recent events and news-flow. When reviewing portfolio progress, long- term context is important.

It is nonetheless pleasing to report that total returns (i.e. including income) for portfolios purely invested in the core Church House fund range are showing modest gains to end-November, ranging from +3.3% at Risk Scale 2 (the ultra cautious strategy) to +7.0% at Risk Scale 8 (the one for the more adventurous investor).

In a year of wild swings, the FTSE 100 is precisely flat over the same period, the FTSE All-Share slightly down (at -0.5%) and the more domestic FTSE 250 -3.3% and AIM -14.2%. Bond markets, similarly, have behaved like supermarket trolleys skidding all over the place as market expectations for the future path of interest rates have veered between hope and dread. UK Gilts are down -4.2%, Index-Linked Stock -5.8% and 5 – 15 yr Corporate Bonds off -0.5% in capital terms. Bond yields move inversely to their prices, so their income has risen. In summary, to say this has been a difficult year is like saying the Anglo Saxons were a bit miffed over 1066.

From a purely investment perspective, there are, however, a few key points worth making.

The course of Love ne’er did run smooth

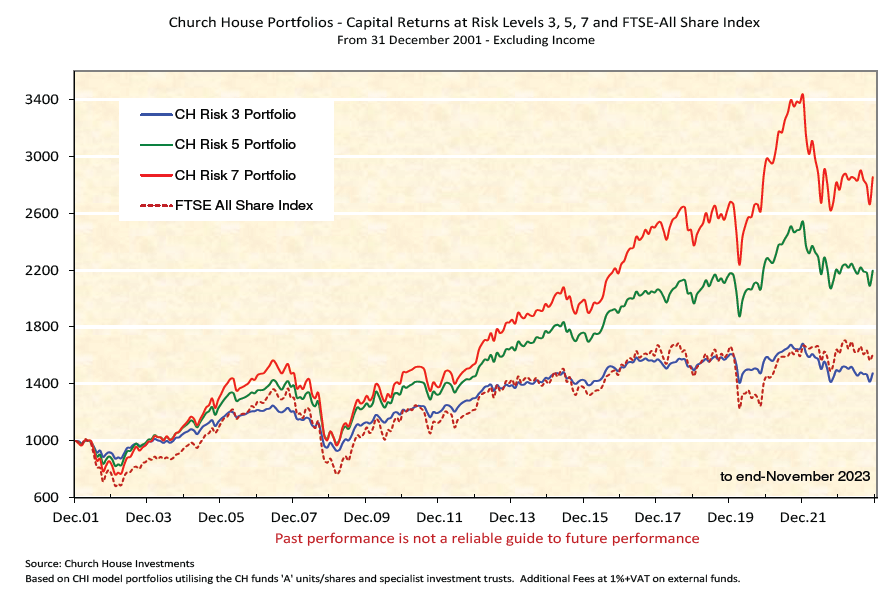

First, markets never go up in straight lines, but they do go up in the end, which is surely what Lysander was referring to in A Midsummer Night’s Dream. Since 1920, despite 17 recessions exacerbated by war, famine and, most recently, pestilence, the S&P 500 has generated annualised returns of 9.5% p.a. Despite remarkable increases in medical science, not all of us can invest for a one-hundred-year timeframe. But the graph of more recent capital returns tells a similar story (but with lower drawdowns).

In a nutshell, this shows the volatility- or potential for loss – of three core portfolios since the turn of the century. The graph illustrates the behaviour of CH cautious, balanced income & growth and higher-risk capital growth strategies during a period of notable crises and crashes including the Dot-Com Crash (’00-’02), the Global Financial Crisis (’07-’08), Trump Trade Wars, Eurozone Debt Crises, the Pandemic, the Ukraine War, the Truss premiership and so on. As ever, instability and uncertainty provide the one constant in the bonkers world we inhabit.

Maintaining discipline

Since interest rates started their steep rise in Dec 2021, markets – and inevitably CH portfolios - have struggled in the face of the relentless rise in the cost of capital. The situation has been exacerbated by the significant widening in discounts of most of the investment trusts which we use to build out portfolio mandates. Those three portfolios shown above tell the story.

The key attribute throughout this period – just beginning to show through now - has been to stick to core disciplines and maintain correct asset allocations – or distribution of eggs in baskets – for clients’ particular investment objectives and risk profiles.

Preservation of capital has always been a key priority for our clients for whom our philosophy and investment strategy is quite simple. We focus on risk, investing in the most suitable segment of a company’s capital structure, from its secured debt at the low-risk end, through to its equity issuance at the other, higher-risk, end. All our investment decisions turn on one over-riding criterion: what is the chance of getting our clients’ money back if things take a turn for the worse? This focus on downside risk has meant, historically, that clients’ capital has remained intact and ready to gain positive traction when markets eventually turn up.

It is why we talk so much about your fixed interest, or bond, exposure because this asset class forms the anchor of so many portfolios. These debt securities - and their all-important fixed coupon payments – have a much higher chance of getting paid out in the event of corporate failure, whereas equity (the shares of the company) can quickly disappear into ‘money heaven’ in similar situations. We review the balance held in portfolios and our expectations for earnings (in the case of equities), or loan repayments (in the case of bonds), on a daily basis to check against bias or the ‘anchoring’ of expectations as the market sands shift under our feet.

The key discipline is to invest in ‘quality’ across the asset spectrum, that is to say, companies with strong franchises, high barriers to entry, reliable earnings and low levels of debt.

In short, the survivors in any unforeseen melt-down.

Rushing from one bus stop to another almost always ensures you miss the bus

There is a distinction between taking action to arrest poor returns and recognising when market conditions are simply against you. During those times of poor returns, such as we have recently experienced, it is always tempting to think someone else might be doing better or to move strategy. There will always be some fund manager who has benefited from what might be termed an ‘outlier strategy’ that has turned up trumps while most others languish in the mid-stream. Every stopped clock is right twice in the day.

More usually, there are times when patience turns out to have been the most important discipline. Of course, there are individual holdings we have ditched because the new environment or future outlook looks too challenging, and we are happy to detail these in fund reports. But for the most part, like a shoal of salmon sitting in a pool awaiting that spate of fresh water to come downstream, we are ‘sitting tight’, a discipline that is much easier to practise when you can be confident that you are invested in quality across the core asset spectrum. We remain confident that even those portfolios exposed to higher-risk growth mandates remain sensibly allocated, well-diversified and adequately protected.

As fund managers operating pools of capital (rather than stockbrokers managing individual portfolios stuck in segregated holdings), we have the luxury of being able to exploit market mis-pricings and low valuations.

As readers of this year’s Quarterly Review fund sections will hopefully have spotted, we have been patiently watching price retreats across chosen asset classes and quietly building positions at levels that provide the potential to deliver exceptional returns in the future.

We remain confident that, in an often shorter timespan than clients anticipate, portfolios will benefit from the significant opportunities exploited during this recent period of dislocations. Meanwhile, clients can take comfort from the significant improvement in income yields that their portfolios now generate, which, in some cases, have nearly doubled from where they were two years ago.

So, to end with some good news, the long period of financial repression meted out on savers and investors by central bank zero-interest-rate policies has at last ended; even un-invested sterling cash held in certain portfolios now earns 4.1% interest p.a. (US $ cash earns 3.85% p.a.)

Important Information

The contents of this article are for information purposes only and do not constitute advice or a personal recommendation. Investors are advised to seek professional advice before entering into any investment arrangements.

Please also note the value of investments and the income you get from them may fall as well as rise and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?