Markets ended 2023 in fine form led by a strong recovery in bond markets as the view that the central banks are done gained traction.

The year started with a US secondary bank crisis (Silicon Valley Bank is already fading from memory) that spread to Europe and brought down Credit Suisse, continuing inflation concerns and repeated increases in rates from the central banks against the backdrop of some grim geo-politics as the war in Ukraine dragged on, China and Taiwan resurfaced as a major concern and a really nasty Israel/Hamas conflict.

It turned out that inflation had peaked everywhere in October 2022, but that didn’t stop the central banks from acting tough and continuing to ratchet up their base rates. Inflation continued to fall through the year though it was slower to react in the UK where it felt distinctly ‘sticky’. The Federal Reserve was the first to ‘pause’ their rate increases in the summer, the Bank of England in August (though it was a rather messy split decision); the ECB carried on until the autumn (still ‘behind the curve’). Autumn saw something of a panic in bond markets as the focus shifted to governments’ ability to finance their deficits and the huge volume of bond sales that implied.

19th October (a significant date for those of us with long memories) turned out to be the bottom for the bond markets and a powerful recovery ensued. The US ten-year bond yield that was nudging 5% on 19th October sank to a low of 3.8% by Christmas, while the ten-year Gilt followed the same pattern from a high of 4.7% down to 3.4%. It is hard not to think that this move has been a shade too speedy and vulnerable to any ‘disappointing’ news. The two-year Gilt yield sank to 3.9% by the year end, sending a strong signal to the Bank, indeed it was quite surprising to see three members of the Bank’s Monetary Policy Committee voting for a further increase in the Base Rate at their mid-December meeting.

Equity markets took their cue from the bond markets and the final two months of the year saw good gains. Even the lacklustre UK market managed to eke out a small gain for the year, but the UK was an outlier as most markets were much stronger led by America and more particularly by the NASDAQ. Outstanding, as they have been all year, were the ‘Magnificent Seven’ of leading US tech stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla). This group more than doubled in value over 2023.

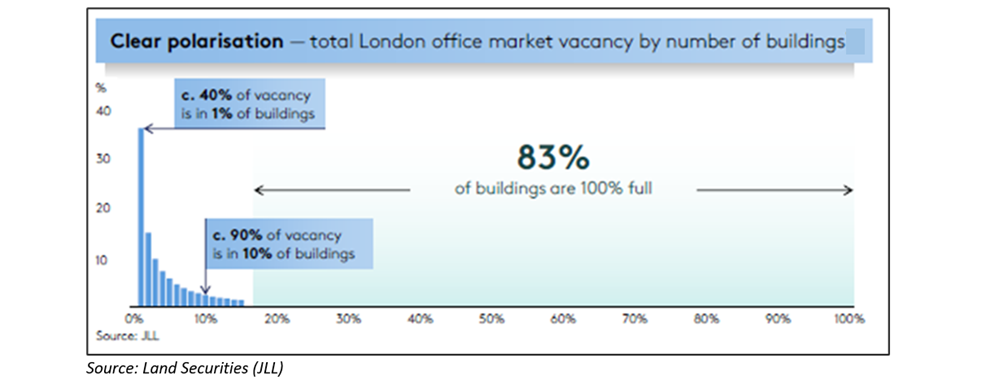

Domestically, it was good to see one of the most unloved asset classes, commercial property, showing signs of a return to life after a torrid few years. London’s two biggest commercial property companies, Land Securities and Segro, showed decent gains for the year having repeatedly hit lows during the year. At a recent meeting, Land Securities shared this interesting chart of London office vacancy with us, which does put some of the more dire headlines into perspective, right.

As we move into 2024, we have the new dimension of elections to consider. Starting with Taiwan and ending with the long run-in to the US Presidential Election and a possible wild card of a UK election if PM Sunak decides to go early, there is plenty of scope for grand-standing and consequent market volatility. Most economists appear to have shifted from the expectation of an imminent recession last year to a belief in a ‘soft landing’ this year. If the Federal Reserve does achieve a soft landing one year after their yield curve first inverted, it will be a first and impressive. Going back over the eight US recessions since the late 1960s, the economy has fallen into recession around one year after the first negative yield curve on each occasion.

We must recall too that a couple of years ago, central banks looked flat-footed and humiliated as the inflation genie escaped and the long shadow of the 1970s loomed. How they react now is all important, but we should not be surprised if they wait too long before cutting rates.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?