October saw a number of chickens coming home to roost in the long end of bond markets and the outbreak of a horrendous war in the Middle East darkening the mood.

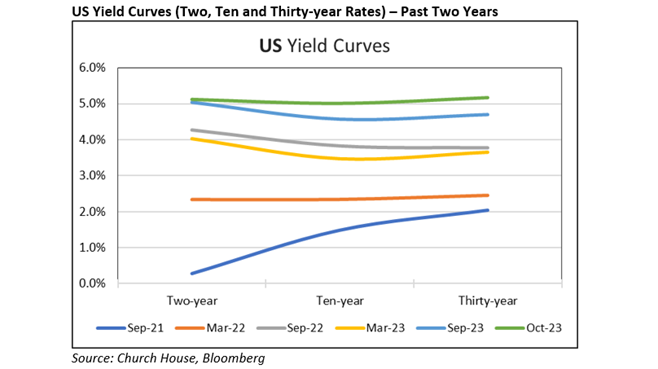

The sheer enormity of the funding required from US bond sales hit home as some Treasury auctions saw faltering demand and the Federal Reserve’s mantra of ‘higher for longer’ sank in. The long end saw steep falls in prices, pushing-up yields and flattening-out the yield curve. Our first chart shows a simple US yield curve starting in September 2021, subsequent six-month intervals and this week’s figures – it has been quite a move, right.

The move in two-year yields is nominally bigger but the simple maths of duration means that holders of longer-dated bonds have seen the steep falls in value (holders of two-year bonds in September 2021 have, of course, been paid out by now). The US ‘long bond’ in September 2021 was the Treasury 2% 2051, which was trading close to ‘par’ (100c) back then, was trading around 54c earlier this week, ouch…

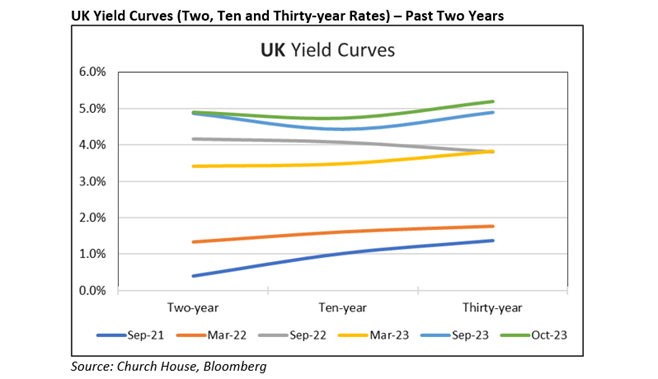

The picture for the UK is broadly similar to the US though it has been even more painful at the long end. Two years ago, the UK thirty-year Gilt was the Treasury 1.25% 2051, back then this Gilt was trading at around 97p (it hit 110p in December 2021), now trading around 44p…

After the Bank of England surprised markets with a ‘hawkish hold’ of the Base Rate at 5.25% last month, we expect them to hold again in early November (while, of course, maintaining that they won’t hesitate to move again if necessary). UK inflation for September was largely unchanged but expect a noticeable fall in CPI for October as the Ofgem price cap falls. Similarly, we expect the European Central Bank to hold rates this month and the US Federal Reserve to do the same next week.

Having said all year that the value in bond markets was at the short end and that the long end was too risky we are not ready to change that call. We view the returns on offer in short-dated debt as very attractive, particularly in short-dated investment grade corporate debt. Clearly, some of the risk has come out of longer-dated bonds but the short end is still the place to be.

Equity markets have taken their cue from the bond markets and fallen across the board. After steep falls in September, US big tech was the exception and steady over this period. But we are just getting into peak quarterly reporting season for Alphabet, Microsoft, Meta etc. so this may change. Oil remains as a major concern, even more so now as we face Middle East violence again, the price did rise as the tragedy unfolded but has settled back and is actually lower over the month so far. US big oil is competing to expand by acquisition, Exxon Mobil is acquiring Pioneer Natural Resources and Chevron is buying Hess. Both ‘doubling down’ on oil and, rather noticeably, adding assets in the Western world.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?