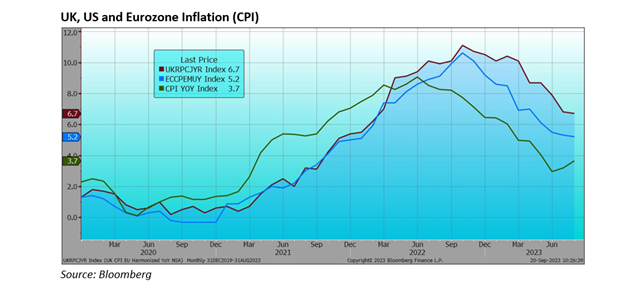

Repeating last month’s report, we start with another look at UK inflation relative to the UK and Europe, which does remain the key to returns at present.

Once again, a month of improving UK figures leaves us looking less out of line than we were earlier in the year, below and right.

Particularly encouraging in the August report was the improvement in ‘core’ CPI (excluding food and energy prices), which fell to 6.2% against expectations of a 6.7% figure. Increasing fuel prices on the back of the rise in the oil price did not have the impact that they had had in other countries on the headline figure. Tonight, we have a decision from the US Federal Reserve on US rates, they are widely expected to maintain their rate at 5.5% with all interest in their commentary and expectations for one (final?) rate increase later in the year.

Tomorrow sees the Bank of England’s decision on Base Rates. An increase to 5.5% is widely expected, with commentary that a pause would now be in order. Today’s inflation figures might give the Monetary Policy Committee pause for thought, I hope so. To quote from GlobalData, TS Lombard’s note this morning entitled: Stop Hiking, BoE

• Downside surprises are the name of the game

• The 3m annualised rate of core inflation has dropped extremely quickly to just 3% in August, from a peak of over 10% in April

• Core services (excluding housing and transportation services) are still running hotter, at 6.5% in August, but slowed from 7.7% in July

• We expect a continued downtrend as the labour market slackens

• Energy bounced back, m/m, but the Ofgem price cap set for October implies more deflation to come

• Further hikes would be a policy mistake

The European Central Bank did raise their base rate to 4.5% but with accompanying commentary that made it clear that this was a stopping point.

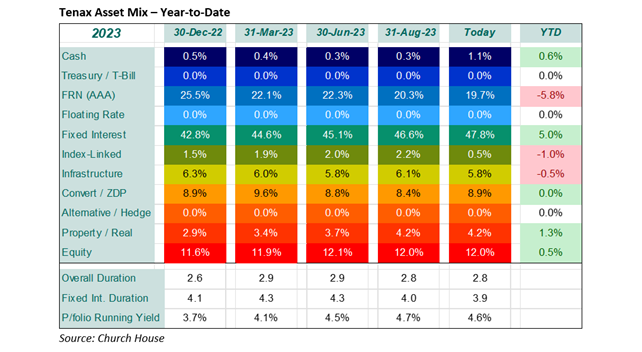

After a fractious August in thin markets, September has seen a better picture with an improvement in bond markets. Equities have been mixed with London and Tokyo better and flat to lower markets elsewhere. Within the Fund’s portfolio we have continued to sharpen the focus on short-dated sterling credit (fixed interest), see the Asset Mix, right.

We have added short-dated sterling bonds from KFW (Kreditanstalt Fuer Wiederaufbau, German government guaranteed), Whitbread and a new issue from Yorkshire Building Society of 7.375% bonds due in 2027. We have also added to the US dollar issue that we hold from Beazley, the 5.5% issue due in 2029, that we are able to purchase at less than 90c. Overall, the redemption yield of the floating and fixed rate portion of the portfolio (just over 2/3 of the whole) has reached 7.1% at a duration of 2.8.

(Duration, as opposed to life to maturity, does confuse many people, please get in touch for a brief explanation…)

The Index-Linked section has reduced as we are seeing better opportunities in conventional fixed interest. We are down to just one zero dividend preference holding in the portfolio now as we saw an attractive opportunity to switch out of one of the remaining holdings into straightforward bonds. But we have been adding to our convertible holdings, so this section has increased overall.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?