We wrote the last of these reports on our activity in Tenax on 25 March just as the markets were attempting to ‘find a bottom’ after the rout of late February early March.

The 23 March was the low point for the S&P 500, which has since rallied by 30%. London also bottomed around the same time but has not had anywhere near as good a recovery, weighed down by the oil majors and banks.

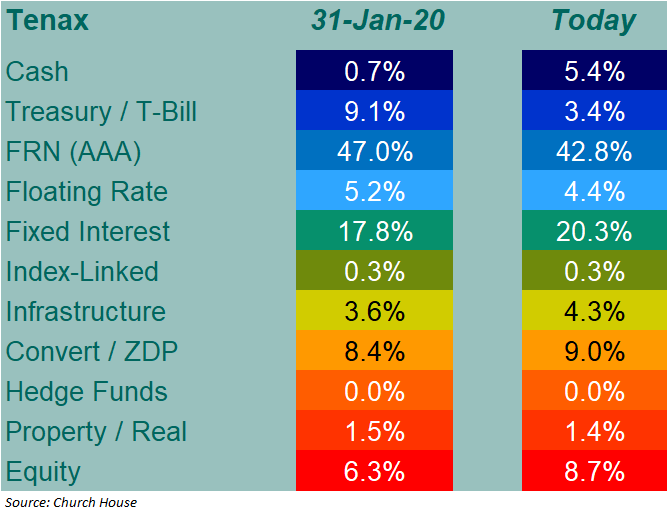

Last month we reported that the majority of our transactions had been in equities, this month the emphasis has firmly returned to the credit markets. Credit markets (re)opened for business in the latter part of March encouraged by the strenuous efforts of the US Federal Reserve, ECB and other central banks. Credit spreads found support around the same time allowing corporates to raise funds. This table shows a comparison of the broad asset class weights at the end of January as compared to 23 April – see table, right.

The new 2.875% issue from Diageo that we referred to last month really got the ball rolling in sterling credit. We participated in that offering and took part in further issues from E.ON (a ‘green’ bond), Volkswagen, BAE Systems (a US dollar issue) and CPPIB Capital (Canadian pensions). We were also happy to establish new positions in existing bonds from BT Group, Marks & Spencer and Tesco.

Of particular interest to us has been the return of some issues to the convertible bond market. We participated in issues from Amadeus IT Group and NEXI. We hope that this trend continues, as we have stated on many occasions, the structure of convertible bonds is particularly attractive for Tenax. Elsewhere there was little to report: we added to our holding in the SDCL Energy Efficiency Trust and bought back into Land Securities again (only wishing that we had sold the entire position at the end of last year, they have halved since then).

How would you like to share this?