The August market lull came particularly early this year as the FTSE 100 remained range bound in the vicinity of the 6000pts level.

The London market continues to lag the pack, having the worst performance of any of the major markets, albeit it ended the month mildly positive.

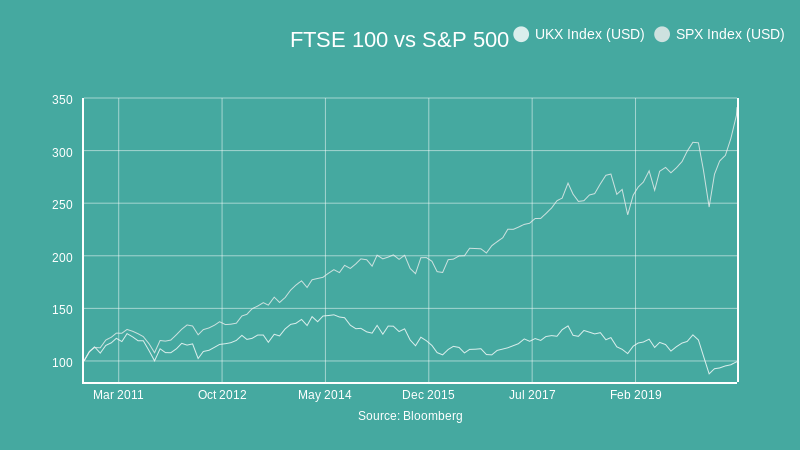

The graph, see right, highlights the ever widening gap between the FTSE 100 and the S&P 500 over 10 years, with the US making regular new all-time highs (a sharp V shaped recovery) whilst the UK is still around 13% off its all-time high.

The S&P 500, with its dominance of tech super-constituents (Apple, Amazon, Alphabet and Facebook), far outshines the big UK index heavyweights of HSBC, Lloyds, Royal Dutch Shell, BP and the miners BHP Group and Rio Tinto. The UK market is fundamentally suffering from having too many price takers (banks, oils etc.) and not enough price makers, such as the dominant Silicon Valley tech businesses. The fact that Apple is now larger than the entirety of the FTSE 100 hammers home the point (but more on that from me next week).

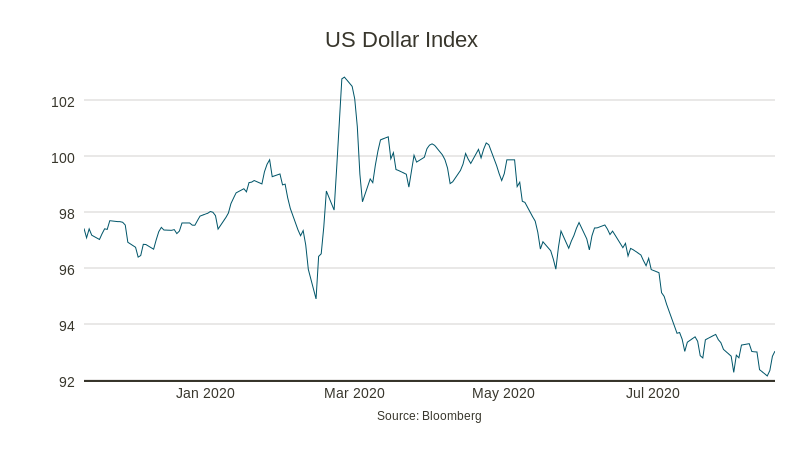

There are some great quality business listed in London (Unilever, Relx, Diageo to mention just a few), although they are currently not enjoying the steep rally in sterling against USD. The Fed’s recent move to an even more dovish stance, allowing for more inflation and employment to run hotter for longer, looks set to exacerbate the dollar’s decline. The fears of returning to a full-blown global currency war like we saw in the 1970s is real.

How would you like to share this?