The UK’s recession appears to have been as shallow as hoped and activity has regained some momentum in the first quarter.

Retail sales have been volatile as ever but overall are encouraging, as is consumer confidence, and if inflation continues to fall back and labour markets remain firm, the Bank’s task should be straightforward despite a looming election.

A damp squib of a budget did nothing for the electoral chance of the Conservatives. Thanks to our fragile level of activity, the UK is also potentially ahead of the Fed in cutting rates though the inflationary consequences from any resulting weakening in sterling would be unwelcome. The moves in our ten-year Gilt yield have been less pronounced than in the US, centred roughly around 4% but still a long way from the 3.5% where they started the year (entailing a near 5% loss in capital value).

Appetite for credit risk remains unabated however and this is evidenced in the stability of credit spreads. Sterling investment grade spreads have tightened in from 1.4% to 1.2% over this first quarter and there continues to be strong demand from investors in both the primary and secondary markets.

The Thames Water story remains localised to them with limited spill-over into other companies in the sector. But it remains as a £16bn problem for holders of their debt. Kemble, the holding company, has already defaulted on its debts at a cost of £1.6bn but relying on the ring-fencing of their operating company (Thames) debt will not necessarily avoid losses or ‘haircuts’.

We did own the Thames 4% 2025 bonds but sold these in January to buy their new longer-dated 7.75% 2044 bond, but we can report that these were sold before it all began to unwind. Their whole capital stack (their stock of debt in issue) now looks to be in a sorry state.

The first quarter’s primary issuance by both corporates and banks was at a record high level since the Global Financial Crisis. All-in yields remain compelling and credit markets have comfortably outperformed the Sovereign bond markets. Moving further up in terms of quality still feels like a sensible tactic as default rates tick up in the lower echelons of high yield and individual credit problems (like Thames Water) come to the fore.

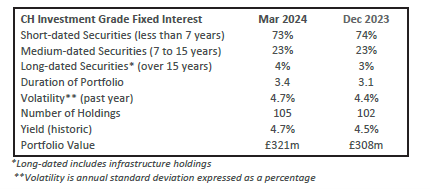

The Investment Grade Fixed Interest Fund was steady over a first quarter that turned out to be distinctly bumpy. The profile of the portfolio is little changed from the end of the year though the duration is slightly longer at 3.3 as we took advantage of some attractive new issues. All changes this quarter are show in the table, right.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?