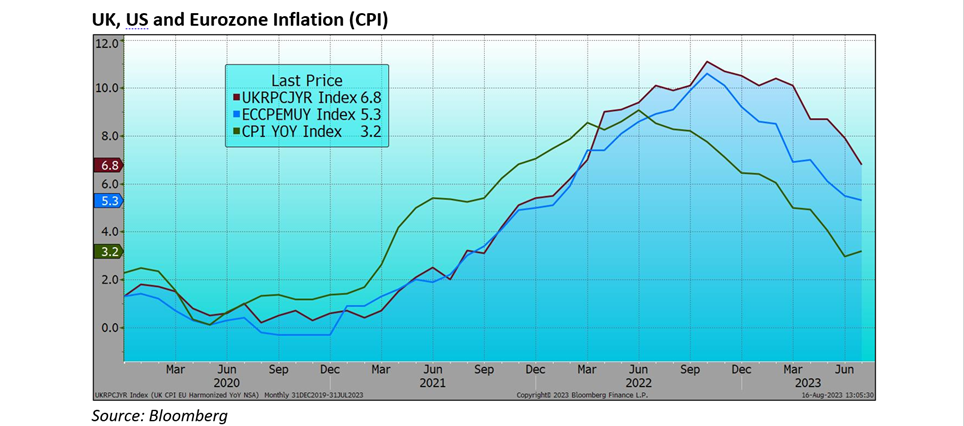

Another month of improvement for the inflation figures leaves the UK looking a shade less out of line with the US and Europe, right.

But this is August, the market is in a fractious mood and determined to look for problems. Yesterday saw the release of UK employment data for June, which demonstrated that the labour market is loosening faster than expected. The unemployment rate climbed to 4.2% (it hit a multi-decade low at 3.5% last August and has been climbing ever since) while the number of vacancies declined. To quote Berenberg’s economists:

The number of vacancies – a proxy for labour demand – fell further in the three months to June to 1.02mn. Vacancies have declined steadily from the record high of 1.3mn in the three months to April 2022. Rising unemployment and falling vacancies increases labour market slack and lowers workers’ wage bargaining power.

But the figures for wage growth (released at the same time) were higher than expected at 7.8% and this has been the focus of commentary and market reaction. I suspect that this too will fade against the weakening employment picture.

The Bank of England did lift the Base Rate by ¼% to 5.25% as did the Federal Reserve to 5.5% and the ECB to 4.25%. All of these base rate moves are beginning to look quite long in the tooth, the ECB is probably done, while the Bank of England and Federal Reserve may have another ¼% to go in the autumn. The Bank did acknowledge that the monetary policy stance is now ‘restrictive’…

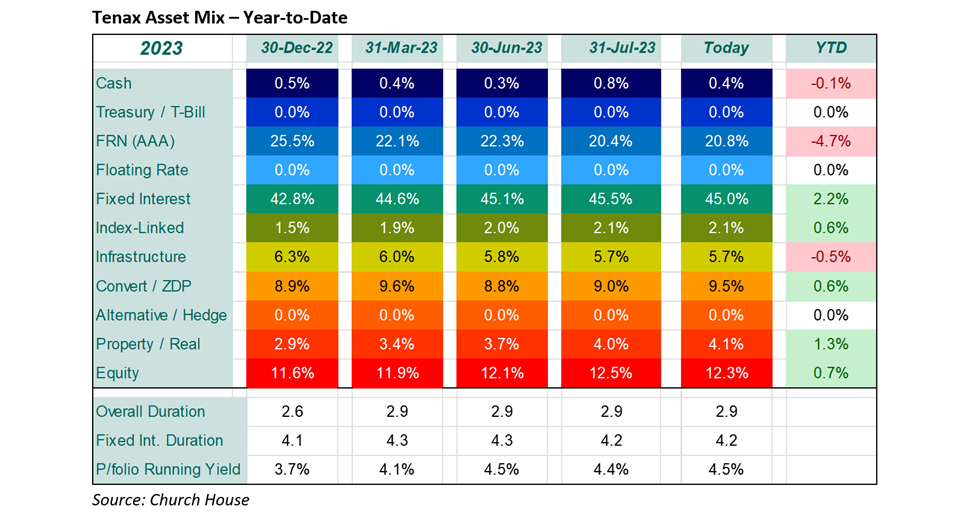

Against a backdrop of another rough month for fixed interest markets, it has been a quiet month for the Tenax Fund and for activity in the portfolio. The ten-year Gilt yield has moved out to 4.65% and the thirty-year to 4.8%, which translates to capital falls of around 3.5% for the ten-year and 7.5% for the thirty-year. It has been a similar pattern in America with the long bond (thirty-year) falling by around 9%.

The asset mix within the Fund is essentially unchanged, still reflecting our preference for short-dated sterling fixed interest markets.

I am feeling like a stuck record on this (possibly that rather dates me), but we are feeling so much more confident now. The returns built-in to the portfolio at short duration (7.25% redemption yield in the Fixed Interest book at a duration of 4.2) gives us predictability, while the one third in other assets just look cheap. The convertibles have even higher redemption yields than the fixed interest for shorter time periods and the infrastructure and property investments are very depressed at present (higher long-term interest rates and the removal of so many buyers from this area of the market thanks to the fee regulations, which, the Treasury tells us, will be repealed soon).

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?